The global Drilling Waste Management Market is expected to experience robust growth as the demand for effective waste management solutions in the oil and gas industry increases. As environmental concerns and strict government regulations surrounding drilling activities intensify, companies are turning to innovative waste management technologies to reduce environmental impact.

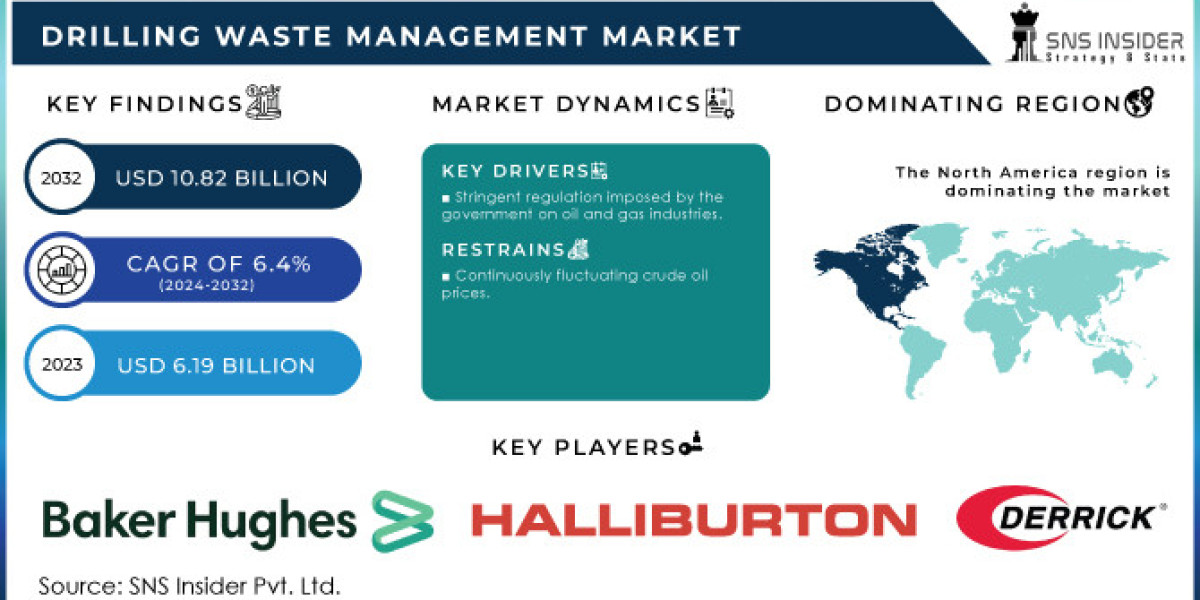

The Drilling Waste Management Market size was valued at USD 6.19 billion in 2023 and is expected to grow to USD 10.82 billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024–2032.

With a growing focus on sustainability, the oil and gas industry is under pressure to adopt safer and more efficient drilling waste management practices. The development of advanced technologies to treat, recycle, and dispose of waste produced during drilling operations is playing a crucial role in minimizing environmental damage, while also meeting stringent regulatory requirements.

Market Overview

Drilling waste is a byproduct of oil and gas exploration and production activities, and it consists of drilling fluids, cuttings, and other waste materials generated during the drilling process. Efficient management of this waste is essential to reduce the risk of soil and water contamination, air pollution, and harm to local ecosystems.

The Drilling Waste Management Market encompasses various techniques and technologies used to treat, recycle, and dispose of drilling waste, including solid control systems, containment and handling, treatment and disposal technologies, and waste recycling and recovery. As environmental protection becomes a priority, oil and gas companies are investing heavily in drilling waste management solutions to ensure regulatory compliance and minimize their environmental footprint.

Download Sample Pages: https://www.snsinsider.com/sample-request/2715

Key Market Drivers

- Stringent Environmental Regulations: Governments around the world are implementing stricter regulations to protect the environment from the adverse impacts of drilling activities. Regulations related to waste disposal, contamination control, and emissions reduction are driving the adoption of more advanced drilling waste management solutions.

- Rising Oil and Gas Exploration Activities: With growing global energy demand, oil and gas exploration activities are on the rise, particularly in remote and offshore regions. As drilling expands, the volume of waste generated increases, creating a higher demand for effective waste management solutions.

- Focus on Sustainability and Eco-Friendly Solutions: The increasing awareness of environmental sustainability has led oil and gas companies to prioritize eco-friendly waste management solutions. Innovations such as waste recycling, treatment technologies, and zero-discharge systems are gaining popularity in the market.

- Technological Advancements in Waste Treatment: Ongoing advancements in drilling waste treatment technologies, such as thermal desorption units, bioremediation, and cuttings re-injection, are making waste management more efficient and cost-effective. These technologies are enabling oil and gas companies to recycle or reuse a larger portion of the waste generated during drilling operations.

- Cost Reduction and Resource Efficiency: Effective waste management not only helps companies comply with regulations but also reduces operational costs. By reusing or recycling waste materials, oil and gas companies can minimize waste disposal costs and improve resource efficiency.

Market Segmentation

The Drilling Waste Management Market can be segmented by service type, application, and region.

By Service Type

- Solid Control: This includes systems designed to separate and remove solid particles from drilling fluids, helping to minimize waste and recycle drilling fluids for reuse. Shale shakers, desanders, and centrifuges are commonly used in solid control.

- Containment and Handling: This segment involves the proper handling, containment, and storage of drilling waste to prevent environmental contamination. Storage pits, tanks, and containment units are used to safely store waste before it is treated or disposed of.

- Treatment and Disposal: Waste treatment methods such as thermal treatment, biological treatment, and chemical treatment are used to reduce the toxicity of drilling waste before disposal. Disposal methods include landfilling, incineration, and cuttings reinjection.

- Waste Recycling and Recovery: This involves recycling drilling fluids and recovering valuable materials from the waste, such as oil and water. Waste recycling technologies help reduce waste volumes and provide economic benefits to drilling operators.

By Application

- Onshore: Onshore drilling activities generate a significant amount of waste that requires proper management. Onshore waste management solutions are essential for protecting land and water resources in areas with high drilling activity.

- Offshore: Offshore drilling presents unique challenges in waste management, particularly with strict regulations governing marine environments. Offshore waste management solutions include advanced containment systems, treatment units, and cuttings reinjection systems to ensure compliance with environmental standards.

Regional Insights

- North America: North America is the leading market for drilling waste management, driven by high levels of oil and gas exploration and production activities in the United States and Canada. The Gulf of Mexico is a key offshore exploration region, while the shale gas boom in the U.S. has significantly increased the volume of drilling waste generated. Stringent environmental regulations and a focus on reducing the environmental impact of drilling are boosting demand for waste management solutions in the region.

- Middle East & Africa: The Middle East, with its vast oil reserves and exploration activities, is a major market for drilling waste management. Countries such as Saudi Arabia, UAE, and Kuwait are focusing on sustainable drilling practices and adhering to environmental regulations to minimize the ecological impact of oil production. Africa, particularly in countries like Nigeria and Angola, is also seeing increased demand for waste management solutions due to the expansion of offshore drilling.

- Europe: Europe is a key player in the market due to stringent environmental protection regulations governing the oil and gas industry. Countries like Norway and the UK have well-established waste management standards for offshore drilling in the North Sea. The European Union’s focus on sustainability and environmental safety is driving the adoption of advanced waste treatment and recycling technologies.

- Asia-Pacific: The Asia-Pacific region, led by countries like China, India, Australia, and Indonesia, is witnessing substantial growth in oil and gas exploration activities. As energy demand in the region rises, the need for effective waste management solutions is also growing, especially in offshore projects. Governments in the region are increasingly enforcing regulations to ensure environmental compliance.

- Latin America: Latin America, particularly Brazil and Mexico, is seeing growing offshore drilling activities in regions such as the Pre-Salt Basin and the Gulf of Mexico. These countries are focusing on modernizing their waste management practices to reduce the environmental impact of exploration activities.

Current Market Trends

- Adoption of Zero Discharge Systems: Zero discharge systems, which aim to eliminate waste discharge into the environment, are gaining traction in the industry. These systems recycle or reinject waste, helping companies meet strict environmental regulations and reduce waste disposal costs.

- Increasing Focus on Waste Minimization: Oil and gas companies are focusing on reducing waste at the source through more efficient drilling techniques, solid control systems, and waste recycling processes.

- Collaboration with Environmental Agencies: Companies are increasingly collaborating with government agencies and environmental organizations to develop best practices for waste management and minimize the ecological footprint of drilling activities.

- Bioremediation and Sustainable Treatment Technologies: Bioremediation, which uses natural organisms to break down contaminants, is emerging as an environmentally friendly solution for treating drilling waste. Sustainable technologies are being developed to reduce the environmental impact of waste treatment and disposal.

Buy Now: https://www.snsinsider.com/checkout/2715

Key Players

The major players are Baker Hughes Company, Halliburton, GN Solids Control, Derrick Corporation, National Oilwell Varco, Inc., Nuverra Environmental Solutions, Inc., Ridgeline Canada, Inc., Schlumberger Limited., Scomi Group Bhd, Secure Energy Services Inc., Tervita, TWMA, Weatherford, KOSUN Machinery Co., Ltd., and other key players will be included in the final report.

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Contact Us:

Akash Anand — Head of Business Development & Strategy

info@snsinsider.com

Phone: +1–415–230–0044 (US)