Managing payroll is a crucial task for any business. Whether you're a small startup or a large corporation, ensuring that employees are paid correctly and on time is essential. A paystub generator is a useful tool that simplifies this process by automatically creating accurate pay stubs for your team. However, not all paystub generators are created equal. To ensure payroll accuracy and efficiency, it's important to select the right paystub generator for your needs.

In this blog, we will discuss the top features to look for in a paystub generator, how it can help you streamline payroll, and why using a reliable paystub generator is essential for your business.

1. Ease of Use

One of the most important features to look for in a paystub generator is its user-friendliness. The tool should be easy to navigate and require minimal input to generate accurate pay stubs. A good paystub generator will have an intuitive interface that allows even those with limited technical knowledge to create pay stubs without difficulty.

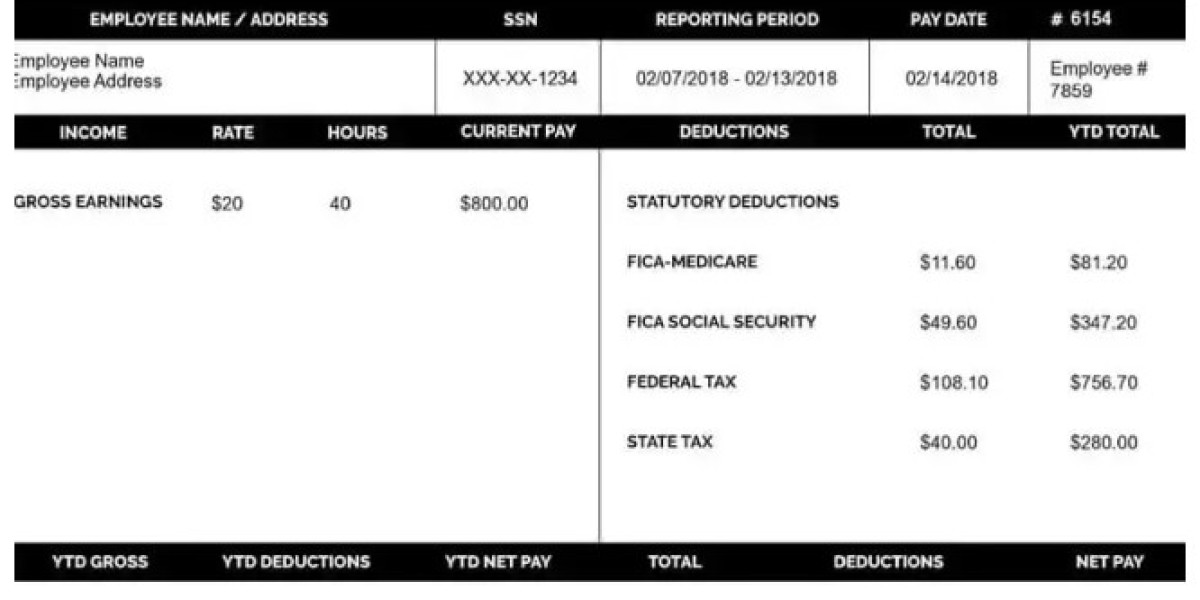

Many paystub generators allow you to input key information such as hours worked, pay rate, deductions, and taxes in simple forms. Once you fill in the required fields, the generator should automatically calculate everything and produce a professional pay stub.

2. Accurate Tax Calculations

Accurate tax calculations are one of the primary reasons for using a paystub generator. In the U.S., payroll tax rates and rules can be complex and vary by state. A reliable paystub generator should automatically calculate federal, state, and local taxes based on the employee’s location and earnings.

The tool should also account for various deductions such as Social Security, Medicare, and other benefits like health insurance or retirement contributions. If your business operates in multiple states or regions, the generator should have the ability to calculate and apply the correct tax rates for each jurisdiction.

3. Customization Options

Every business has different payroll needs. Some employees work hourly, while others are salaried. Some businesses offer bonuses, tips, or commissions, while others don’t. A good paystub generator will allow for customization to fit your business’s specific payroll structure.

Look for a paystub generator that allows you to:

- Add custom deductions for things like health insurance, retirement plans, or union dues.

- Include overtime or shift differentials.

- Show bonuses or commissions separately.

- Customize the pay stub layout and design to match your company branding.

Customizability ensures that your pay stubs reflect the unique aspects of your business and employees, helping to avoid errors and confusion.

4. Secure Data Storage

Security is a top priority when it comes to payroll. Pay stubs contain sensitive information such as employee names, salaries, tax details, and other private data. When choosing a paystub generator, it’s important to ensure that the tool offers secure data storage.

Look for a paystub generator that:

- Stores pay stubs in an encrypted cloud storage system to protect sensitive data.

- Provides access only to authorized personnel.

- Allows for easy retrieval of pay stubs when needed, without compromising security.

The best paystub generators offer secure, cloud-based storage that ensures both employers and employees can access pay stubs at any time, from anywhere, without risk of unauthorized access.

5. Compliance with Labor Laws

Payroll laws in the U.S. are constantly evolving. For example, the minimum wage can differ from state to state, and tax regulations can change year to year. A paystub generator should stay up to date with the latest labor laws and tax regulations to ensure your pay stubs are compliant.

Look for a paystub generator that:

- Keeps track of federal, state, and local laws.

- Automatically updates the software to reflect changes in tax laws or minimum wage rates.

- Generates pay stubs that are legally compliant for both federal and state labor law standards.

Using a paystub generator that stays current with labor laws helps protect your business from penalties or fines associated with non-compliance.

6. Mobile-Friendly Access

In today’s fast-paced world, having access to payroll information on the go is more important than ever. Many employees prefer to check their pay stubs on their mobile devices, especially if they’re working remotely or from various locations.

Choose a paystub generator that is mobile-friendly and allows both employers and employees to access pay stubs through smartphones or tablets. This makes it easier to manage payroll and gives employees the flexibility to review their pay stubs from anywhere.

7. Integration with Accounting Software

Your paystub generator should integrate seamlessly with your accounting and bookkeeping systems. This integration helps to avoid manual data entry and ensures that your financial records remain accurate and up to date.

Look for a paystub generator that:

- Syncs with popular accounting software like QuickBooks, Xero, or FreshBooks.

- Allows for automatic export of pay stub data to your accounting platform.

- Facilitates direct deposit payments by integrating with payroll systems.

This integration saves time and reduces the risk of human error, allowing for more efficient payroll management.

8. Multiple Payment Frequency Support

Different businesses have different payroll schedules. Some pay employees weekly, while others pay bi-weekly, semi-monthly, or monthly. A flexible paystub generator should support various payment frequencies.

Look for a paystub generator that allows you to:

- Create pay stubs for employees on different payroll schedules.

- Easily switch between payment frequencies.

- Accurately calculate earnings based on the employee's pay schedule.

Supporting multiple payment frequencies ensures that your pay stubs are always accurate, regardless of how often you pay your employees.

9. Employee Self-Service Access

Employees like to have direct access to their pay stubs whenever they need them. A paystub generator that offers a self-service portal allows employees to log in and view, download, or print their pay stubs at any time.

This feature helps reduce the burden on HR and payroll teams and empowers employees to access their payroll information independently. It also helps prevent errors related to missing or lost pay stubs.

10. Affordability and Scalability

Finally, consider the cost and scalability of the paystub generator. While it’s important to select a tool that meets your current needs, it’s equally important to choose one that can scale as your business grows.

Look for a paystub generator that:

- Offers affordable pricing plans based on the size of your business.

- Allows you to add new employees without incurring significant extra costs.

- Offers features that grow with your business, such as advanced tax calculations or multi-location support.

A paystub generator should be an investment that provides long-term value by saving you time, reducing errors, and improving payroll accuracy.

Conclusion

A free paystub generator is an essential tool for businesses that want to streamline their payroll processes while ensuring accuracy and compliance. The right generator will save you time, reduce errors, and provide employees with a professional and accurate record of their earnings. When choosing a paystub generator, make sure to consider ease of use, accuracy in tax calculations, customization options, and security features.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide