In today’s fast-paced world, managing finances can often be a complicated task. Whether you’re a business owner, a freelancer, or an employee, keeping track of your income, taxes, and other deductions is crucial. One of the most effective ways to ensure accuracy in these records is by using a paystub creator.

A paystub is a document that provides detailed information about an employee’s pay. It outlines earnings, deductions, and other important details that help employees and employers alike track financial information. In this blog, we will explore how a paystub creator can help you maintain accurate financial records, and why it’s essential for individuals and businesses.

What is a Paystub Creator?

A paystub creator is an online tool or software that generates pay stubs for individuals or businesses. It automatically calculates earnings, deductions, and net pay, ensuring accuracy and consistency in financial records. These creators are designed to be user-friendly, requiring minimal effort to input data while delivering a professional-looking paystub.

For businesses, especially small and medium-sized enterprises (SMEs), using a paystub creator eliminates the need for manual calculations and reduces the chances of errors. It also saves valuable time and effort that could be spent on other aspects of the business.

How Does a Paystub Creator Work?

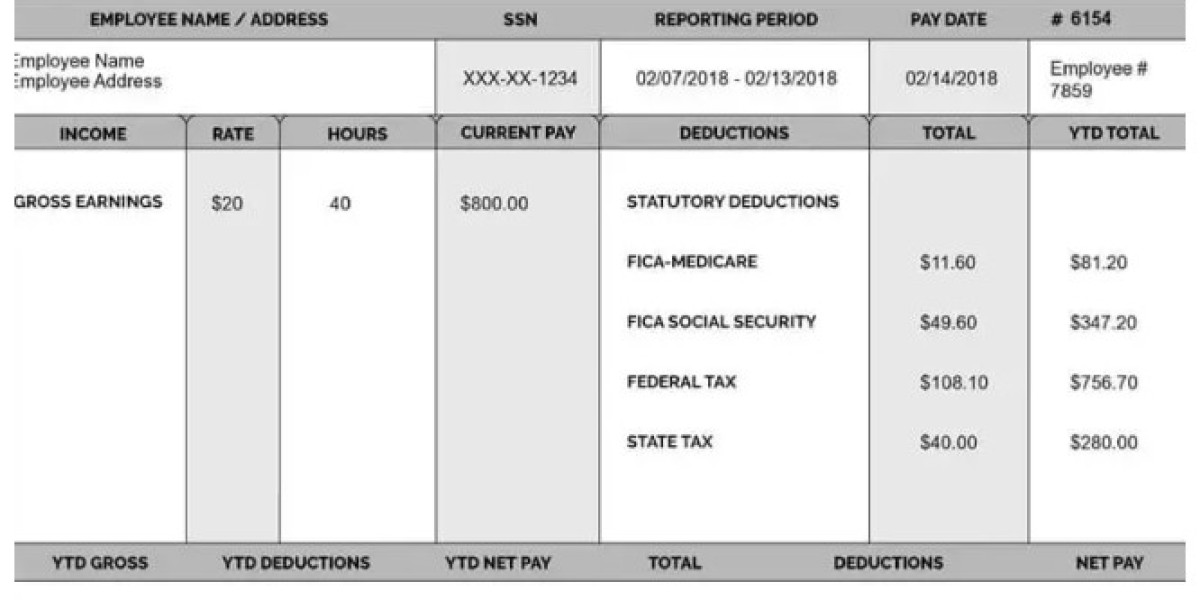

A paystub creator works by allowing users to enter basic information such as:

- Employee details (name, address, job title)

- Payment period (weekly, bi-weekly, monthly)

- Gross income (before deductions)

- Deductions (taxes, insurance, retirement contributions)

- Net income (after deductions)

The tool then automatically calculates the necessary deductions based on the inputs and generates a paystub. Many paystub creators even allow you to customize the document to include additional details like bonuses, overtime, and commissions.

Benefits of Using a Paystub Creator

1. Ensures Accuracy

Manual calculations can often lead to mistakes, especially when dealing with complex deductions or overtime payments. A paystub creator automates this process, reducing the risk of errors and ensuring that the numbers on the paystub are correct. This is particularly helpful when calculating taxes, as errors in tax withholding can lead to penalties or overpayment.

By relying on a paystub generator, both employees and employers can rest assured that their financial records are precise and free from miscalculations.

2. Saves Time and Effort

Creating pay stubs manually can be a time-consuming process. Business owners often have to juggle multiple tasks, and taking the time to generate accurate pay stubs can take away from more important work. With a paystub creator, the process becomes quick and simple, allowing users to generate pay stubs in just a few minutes.

This is especially beneficial for small business owners or freelancers who may not have dedicated HR or accounting departments to handle payroll tasks.

3. Helps with Tax Preparation

Tax season can be stressful for anyone, especially for business owners and employees who need to keep track of all their earnings and deductions. A paystub creator provides a detailed breakdown of all the necessary information, which is useful when filing taxes.

Having accurate pay stubs means that employees and employers have an easier time gathering documents for tax filings, helping to avoid last-minute scrambling. A paystub can also serve as proof of income when applying for loans, renting a home, or seeking credit.

4. Improves Record Keeping

Good record-keeping is key to financial success. A paystub creator not only generates pay stubs but also helps you keep them organized. These digital pay stubs can be saved and stored securely, allowing easy access when needed for future reference.

For business owners, keeping a record of all employees' pay stubs is essential for audits, financial planning, and legal purposes. A paystub creator helps streamline this process, ensuring that records are consistently maintained and readily accessible.

5. Compliance with Legal Requirements

In the United States, businesses are required to provide employees with pay stubs to ensure transparency in earnings and deductions. Failure to provide these records can result in legal issues or fines. Using a paystub creator helps businesses stay compliant with local, state, and federal laws.

Additionally, since paystub creators are often updated with the latest tax rules and regulations, they ensure that all the correct tax rates and deductions are applied, helping employers avoid potential fines from non-compliance.

6. Professional Appearance

For freelancers and small business owners, having professional pay stubs can add credibility to their business. A well-structured paystub generated by a paystub creator can be a clear and professional way of presenting earnings, which can build trust with clients and employees.

Having professional pay stubs also makes it easier for employees to understand their pay breakdown, enhancing transparency within the organization.

Key Features to Look for in a Paystub Creator

When choosing a paystub creator, there are several features to consider to ensure you select the right tool for your needs:

1. Customization Options

The ability to customize pay stubs with your company logo, employee details, and pay breakdown is crucial. Look for a paystub creator that offers customization so that you can tailor the document to your specific requirements.

2. Tax Calculation Features

Ensure the paystub creator automatically calculates federal, state, and local taxes according to the latest rates. This will save you the hassle of manually updating tax rates and ensure accuracy in deductions.

3. User-Friendly Interface

A good paystub creator should have a simple, intuitive interface that allows users to generate pay stubs quickly without technical know-how. Easy-to-use tools help save time and reduce the likelihood of errors.

4. Secure Storage Options

Security is essential when handling financial data. Choose a paystub creator that offers encrypted storage for your pay stubs and allows you to store them safely for future access.

5. Download and Printing Options

The ability to download pay stubs in different formats (PDF, Excel, etc.) or print them directly is important. This ensures you can easily share pay stubs with employees, clients, or tax authorities.

Who Benefits from Using a Paystub Creator?

Business Owners and Employers

Business owners, especially those with small or growing businesses, often find it difficult to keep track of employee payments manually. A paystub creator simplifies the payroll process, helping employers stay organized and compliant with tax laws. It also makes it easier for them to provide proof of earnings for their employees.

Freelancers and Contractors

Freelancers and contractors can also benefit from a paystub creator, as it provides a professional way to document income, track payments, and maintain financial records. This is especially helpful when submitting invoices or applying for loans.

Employees

Employees benefit from paystub creators because they provide transparency in pay, deductions, and benefits. These pay stubs help employees keep track of their earnings, ensuring they are paid correctly. Additionally, pay stubs can be useful when applying for mortgages, car loans, or other financial products.

Conclusion

Maintaining accurate financial records is vital for individuals and businesses alike. Whether you’re an employee, freelancer, or employer, using a paystub creator can help you stay organized, ensure accuracy, and streamline the payroll process. From simplifying tax preparation to providing professional pay stubs, these tools offer a wealth of benefits that can help you maintain a clear and reliable financial record.

If you're looking for an easy, efficient way to manage your financial records, a free paystub creator is the tool you need.