In today’s digital world, businesses and individuals alike are turning to check stubs makers to simplify payroll and financial record-keeping. Whether you’re a small business owner managing payroll for employees or an individual looking to keep track of your income, check stubs makers provide a quick and efficient way to generate accurate pay stubs.

However, as with any financial tool, many people have questions about how check stub maker work, their benefits, and how to use them correctly. In this blog, we’ll dive into the most frequently asked questions about check stubs makers and provide clear, easy-to-understand answers. We’ll cover everything from how they work to their legality, security concerns, and how to choose the right one for your needs.

What Is a Check Stubs Maker?

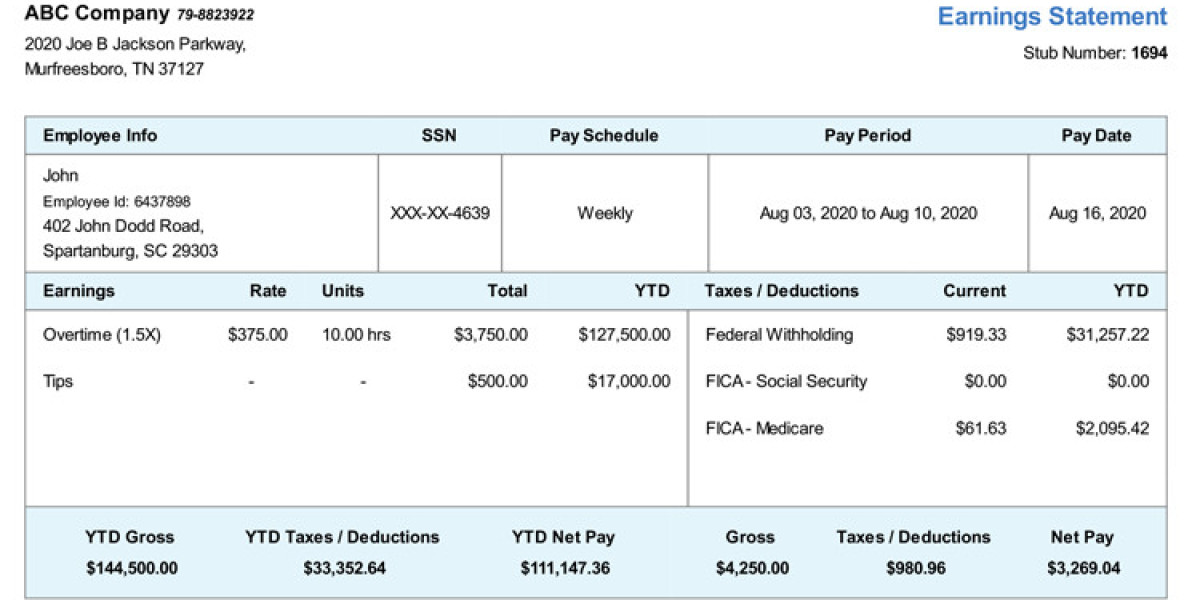

A check stubs maker is an online tool or software that helps businesses, freelancers, and individuals create professional pay stubs. A pay stub is a document that outlines the details of an employee’s or contractor’s earnings, including wages, deductions, and taxes.

Check stubs makers allow users to input financial data like hours worked, salary, deductions, and benefits, and the tool automatically generates a professional-looking pay stub that can be printed, downloaded, or saved for record-keeping. They are used by people across various industries, from small businesses to freelancers, to maintain an accurate record of income and payment details.

Why Should I Use a Check Stubs Maker?

Using a check stubs maker comes with several benefits, whether you’re an employer or an individual. Here are some reasons why you should consider using one:

1. Saves Time

Check stubs makers eliminate the need to manually create pay stubs, which can be time-consuming and prone to errors. Instead of spending hours calculating wages, taxes, and deductions, you can input the necessary details into the tool, and the pay stub is generated in minutes.

2. Accuracy

Calculating deductions and taxes can be tricky, and even small mistakes can lead to bigger problems down the road. Check stub makers use formulas to automatically calculate the correct amounts for deductions, taxes, and net pay, ensuring your pay stubs are accurate.

3. Professional Appearance

If you’re running a small business or working as a freelancer, providing professional-looking pay stubs can enhance your credibility. Check stubs makers provide clean, well-organized documents that can be shared with employees, contractors, or clients.

4. Easy Record-Keeping

It’s important to keep records of earnings and payments for both tax purposes and personal financial management. Check stubs makers allow you to store and retrieve pay stubs easily, helping you stay organized and prepared for tax season or any financial audits.

Are Check Stubs Makers Legal?

Yes, check stubs makers are legal as long as they are used correctly and honestly. It’s crucial that the information entered into the check stubs maker is accurate and reflects the true earnings, deductions, and taxes. Creating fake or misleading pay stubs is illegal and could result in serious legal consequences, including fines or criminal charges.

For business owners, it’s important to ensure that the pay stubs you generate comply with labor laws and tax regulations. As long as you use a check stubs maker to create accurate and legitimate records, it is a perfectly legal tool for managing payroll.

How Does a Check Stubs Maker Work?

A check stubs maker simplifies the process of creating pay stubs by automating calculations for earnings, deductions, and taxes. Here’s a step-by-step breakdown of how a typical check stubs maker works:

1. Input Earnings Information

You start by entering details about the employee or contractor’s earnings. This could include hourly wages, salary, overtime pay, bonuses, or any other form of compensation.

2. Enter Deductions and Taxes

Next, you input any deductions that need to be applied, such as federal, state, and local taxes, Social Security, Medicare, and other benefits like health insurance or retirement contributions. The check stubs maker will automatically calculate these deductions based on the information you provide.

3. Review Net Pay

Once the deductions are applied, the tool will show the net pay—the amount the employee or contractor will receive after taxes and deductions. This is the final take-home pay.

4. Generate the Pay Stub

After reviewing all the information, the check stubs maker will generate a pay stub that you can download, print, or save for your records.

Are Free Check Stubs Makers Safe to Use?

Safety and security are common concerns when using any online tool, especially those dealing with sensitive financial data. Many free check stubs makers are safe, but you should always ensure the platform you’re using has the following security features:

1. Encryption

The platform should use encryption (such as SSL or TLS) to protect your data during transmission. This ensures that any information you enter is protected from hackers or third-party interception.

2. Privacy Policy

Make sure the check stubs maker has a clear and transparent privacy policy. The policy should explain how your data is collected, stored, and used, and it should guarantee that your information will not be sold to third parties.

3. Regular Updates

The platform should be regularly updated to address any security vulnerabilities. Using an outdated tool increases the risk of data breaches.

If you’re unsure about the safety of a free check stubs maker, it’s a good idea to read user reviews or do some research on the platform’s reputation before using it.

Can I Use a Check Stubs Maker for Personal Record-Keeping?

Yes, check stubs makers are useful tools for personal record-keeping, especially for freelancers or contractors who need to keep track of their income for tax purposes. You can use a check stubs maker to generate pay stubs for each payment you receive, helping you stay organized throughout the year.

Having pay stubs on hand can also be beneficial when applying for loans, renting an apartment, or providing proof of income in other situations.

What Information Do I Need to Create a Pay Stub?

To create a pay stub using a check stubs maker, you’ll need the following basic information:

1. Personal Information

You’ll need to provide the employee’s or contractor’s name, address, and Social Security number. For businesses, you’ll also need to input your company’s details, such as the business name and employer identification number (EIN).

2. Earnings Information

Include the total hours worked, hourly rate (if applicable), salary, overtime pay, bonuses, or other forms of compensation.

3. Deductions and Taxes

Input any deductions such as federal and state taxes, Social Security, Medicare, health insurance, or retirement contributions. The check stubs maker will calculate the total deductions and apply them to the gross pay.

4. Pay Period and Date

You’ll need to specify the pay period (e.g., weekly, bi-weekly, monthly) and the date of the payment.

How Do I Choose the Right Check Stubs Maker?

There are many check stubs makers available online, so how do you choose the right one for your needs? Here are some tips to help you decide:

1. Ease of Use

Choose a platform that is user-friendly and doesn’t require extensive financial knowledge. The process of creating a pay stub should be quick and straightforward.

2. Customization Options

Look for a check stubs maker that allows you to customize your pay stubs, including adding your business logo, selecting different templates, or adjusting the layout.

3. Security

As mentioned earlier, security is crucial when dealing with sensitive financial data. Ensure the platform uses encryption and has a strong privacy policy.

4. Price

While many check stub makers offer free versions, some may require payment for additional features. Compare the cost of various platforms and choose one that fits within your budget while offering the features you need.

5. Customer Support

If you run into issues or have questions, having access to customer support can be helpful. Look for platforms that offer responsive customer service through email, chat, or phone.

Conclusion

Check stubs makers are a valuable tool for businesses, freelancers, and individuals who need a fast and easy way to generate pay stubs. By answering some of the most frequently asked questions about these tools, we hope you now have a better understanding of how they work and why they’re useful.

Whether you’re using a check stubs maker for personal record-keeping or to manage payroll for your business, make sure to choose a platform that prioritizes accuracy, security, and ease of use.