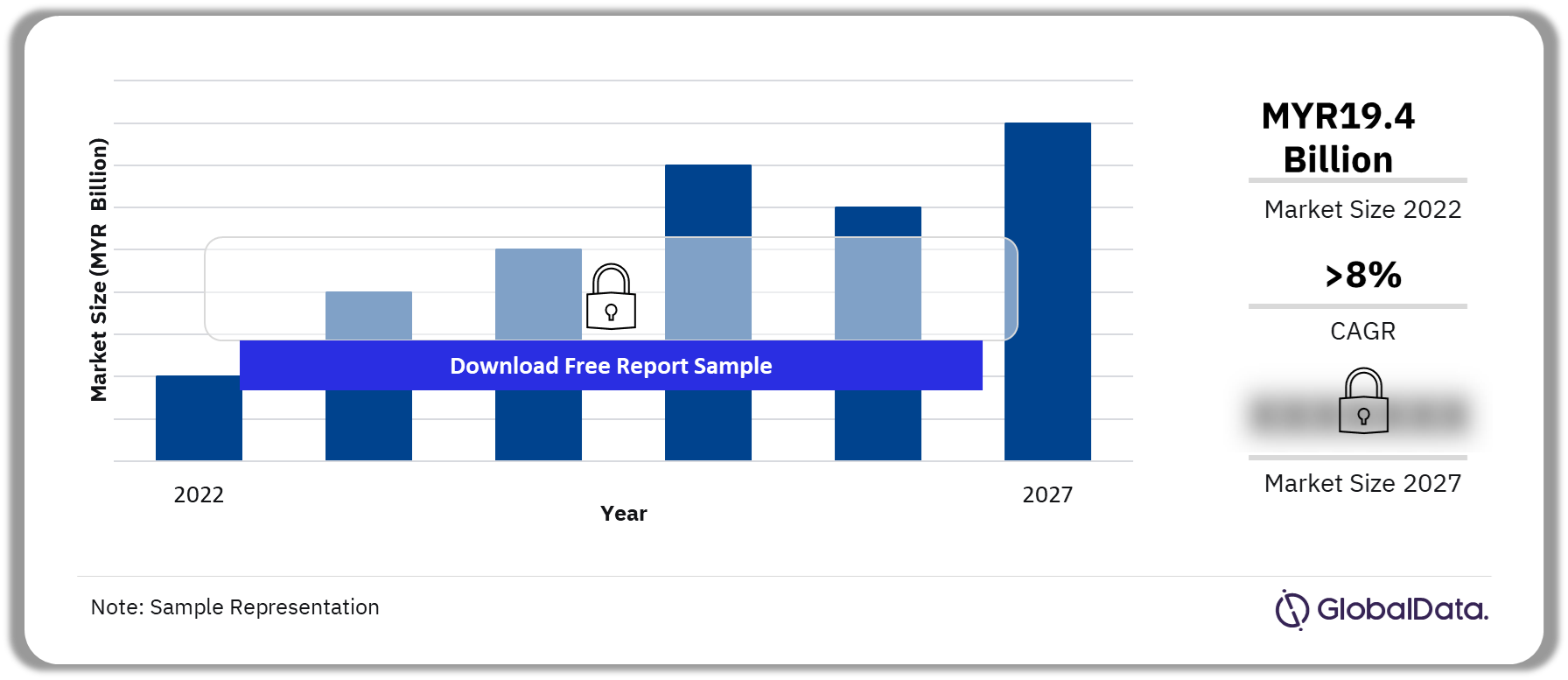

The Malaysia general insurance market analysis report from GlobalData highlights key trends, challenges, opportunities, and growth forecasts that shape the future of the industry. The motor insurance segment remains dominant, but other sectors such as health and liability insurance are gaining traction due to increasing demand from individuals and businesses.

Buy Full Report for More Information about the Malaysia General Insurance Market Forecast Download a Free Report Sample

Key Market Trends

Digital Transformation

The digitalization of the insurance sector is one of the key trends driving market growth. Insurers are increasingly adopting digital platforms and technologies such as artificial intelligence (AI), machine learning, and big data analytics to improve customer experience, enhance underwriting processes, and streamline claims management. Online platforms have made it easier for customers to compare products, get quotes, and purchase policies, resulting in a more customer-centric approach.Rising Demand for Health Insurance

The health insurance segment has witnessed a significant increase in demand, driven by rising healthcare costs and growing consumer awareness of the need for medical coverage. In the wake of the COVID-19 pandemic, consumers are more inclined to invest in health insurance plans that offer comprehensive coverage for critical illnesses and hospitalizations.Regulatory Developments

The Malaysian government and regulatory bodies, such as Bank Negara Malaysia (BNM), continue to focus on improving the insurance landscape through regulatory reforms. These efforts aim to enhance market transparency, improve consumer protection, and promote the adoption of risk-based capital frameworks. The implementation of IFRS 17 is expected to increase compliance and reporting standards in the insurance industry.Growth of Takaful Insurance

Takaful insurance, which is based on Islamic principles, continues to grow in popularity in Malaysia. As a Sharia-compliant alternative to conventional insurance, Takaful is attractive to the country’s Muslim population, which accounts for over 60% of the total population. The demand for Takaful products is expected to rise further, driven by increasing awareness and new product innovations tailored to the needs of Muslim consumers.Telematics and Usage-Based Insurance (UBI)

Telematics and UBI are gaining momentum in the motor insurance sector. These technologies allow insurers to collect data on driving behavior and vehicle usage, enabling them to offer personalized premiums based on risk. This has led to more competitive pricing models and a reduction in fraud cases, as insurers have better access to real-time driving data.