Managing payroll can be one of the most challenging tasks for business owners and HR professionals. The complexities of payroll systems often lead to confusion, errors, and dissatisfaction among employees. Fortunately, tools like a check stub maker can simplify this process, making it easier for you to create accurate pay stubs and ensure a smooth payroll experience. In this blog, we’ll explore what a check stub maker is, how it works, its benefits, and why it’s essential for businesses of all sizes.

Understanding Payroll and Pay Stubs

Before diving into the specifics of a check stub maker, let’s first understand what payroll is and what a pay stub entails.

What is Payroll?

Payroll refers to the process by which employers pay their employees for the work they have done. It includes calculating wages, withholding taxes, and other deductions, and ensuring that employees receive their paychecks on time. Payroll can be complicated, especially when you consider factors such as:

- Employee classifications (full-time, part-time, contractors)

- Overtime and bonus calculations

- State and federal tax regulations

- Deductions for benefits like health insurance and retirement plans

What is a Pay Stub?

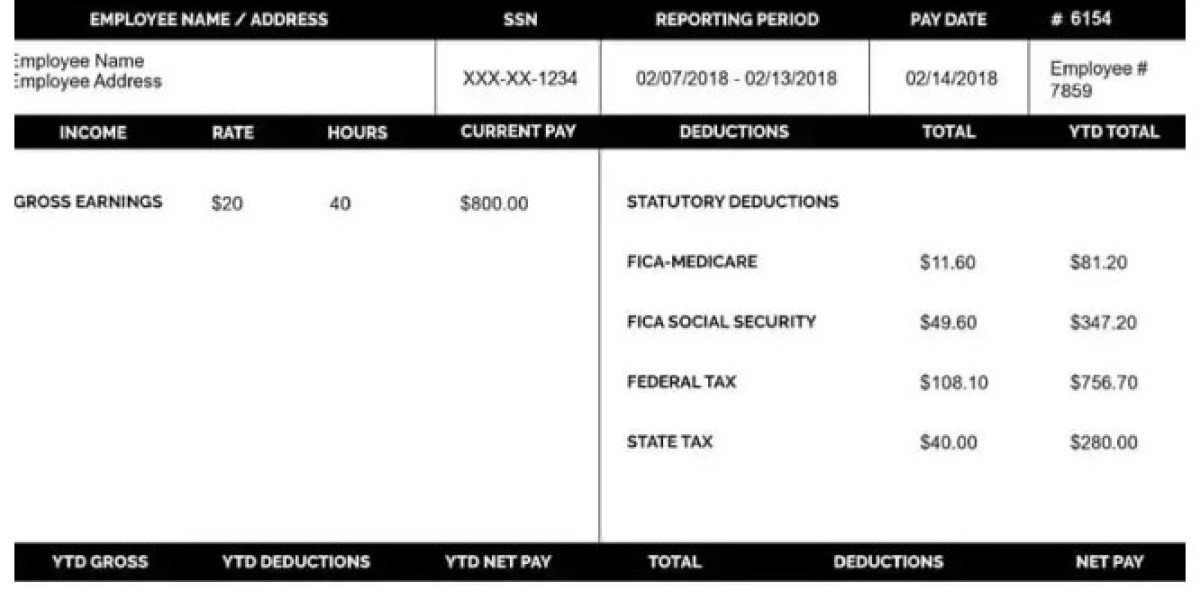

A pay stub is a document that details the earnings and deductions of an employee for a specific pay period. It typically includes:

- Gross pay: The total amount earned before any deductions

- Net pay: The amount the employee takes home after deductions

- Deductions: Taxes, benefits, and other withholdings

- Year-to-date (YTD) totals: Cumulative earnings and deductions for the calendar year

Providing accurate pay stubs is not just good practice; it’s often required by law in many states.

What is a Check Stub Maker?

A check stub maker is an online tool or software that helps businesses create professional pay stubs quickly and easily. Instead of spending hours calculating wages and formatting documents, a check stub maker allows you to input basic information and generate a pay stub instantly.

Key Features of a Check Stub Maker

- User-Friendly Interface: Most check stub makers are designed to be easy to use, even for those with little technical knowledge.

- Customizable Templates: You can choose from various templates that suit your business’s branding, ensuring your pay stubs look professional.

- Accurate Calculations: Many check stub makers automatically calculate taxes and deductions based on the information you provide.

- Secure Data Handling: Reputable check stub makers prioritize data security to protect your sensitive employee information.

- Instant Download and Printing: Once you create a pay stub, you can download it as a PDF and print it out immediately.

Why Use a Check Stub Maker?

Using a check stub maker comes with several benefits that can improve your payroll process and enhance your business’s efficiency.

1. Time-Saving

Creating pay stubs manually can be time-consuming. With a check stub maker, you can generate pay stubs in just a few minutes, freeing up valuable time to focus on other aspects of your business.

2. Accuracy

Manual calculations can lead to errors that might result in underpayment or overpayment. A check stub maker automates calculations, reducing the chances of mistakes and ensuring that your employees receive accurate pay.

3. Professional Appearance

A well-designed pay stub adds a level of professionalism to your business. Customizable templates allow you to present your brand effectively, making a good impression on your employees.

4. Compliance

By using a check stub maker, you can ensure that your pay stubs comply with federal and state regulations. This reduces the risk of legal issues related to payroll.

5. Accessibility

Most check stub makers are online tools, meaning you can access them from anywhere with an internet connection. This is particularly useful for remote businesses or those with multiple locations.

6. Cost-Effective

Investing in a check stub maker can save you money in the long run. By reducing the time spent on payroll and minimizing errors, you can avoid costly penalties and fines.

How to Use a Check Stub Maker

Using a check stub maker is generally straightforward. Here’s a step-by-step guide to help you get started:

Step 1: Choose Your Check Stub Maker

There are many check stub makers available online. Look for one that has positive reviews, offers a user-friendly interface, and provides secure data handling.

Step 2: Enter Employee Information

Input the necessary employee information, such as:

- Employee name

- Employee ID or social security number

- Pay period start and end dates

- Pay rate (hourly or salary)

Step 3: Input Earnings and Deductions

Enter the gross pay for the pay period and any additional earnings (like bonuses or overtime). Then, input any deductions, including:

- Federal and state taxes

- Social Security and Medicare

- Retirement contributions

- Health insurance premiums

Step 4: Review and Customize

Before generating the pay stub, review all the information you entered. Ensure everything is accurate. If the check stub maker allows for customization, choose a template that aligns with your brand.

Step 5: Generate and Download

Once you’re satisfied with the information, click the button to generate the pay stub. You can then download it as a PDF for printing or sharing with your employees.

Step 6: Store Securely

Keep a secure digital copy of each pay stub for your records. This will help you maintain compliance and provide documentation if needed in the future.

Common Misconceptions about Check Stub Makers

As with any tool, there are misconceptions about check stub makers that can deter business owners from using them. Let’s address some of these myths:

Myth 1: They’re Only for Large Businesses

Many small businesses can benefit from using a check stub maker. The tool is designed to streamline payroll for businesses of all sizes.

Myth 2: They’re Complicated to Use

Most check stub makers are designed with simplicity in mind. Even those who are not tech-savvy can quickly learn to use them.

Myth 3: They’re Not Secure

Reputable check stub makers prioritize security. They often use encryption and other safety measures to protect your data.

Conclusion

In a world where businesses face numerous challenges, managing payroll shouldn’t be one of them. A check stubs maker offers a simple, efficient solution to the complexities of payroll systems. By saving time, increasing accuracy, and ensuring compliance, this tool can enhance your payroll process and improve employee satisfaction.

Whether you're a small business owner or part of an HR team, adopting a check stub maker can transform how you manage payroll. As you streamline your operations and present a professional image, you'll find that a check stub maker is not just a luxury but a necessity in today’s business environment.

By incorporating this tool into your payroll practices, you can focus on what truly matters—growing your business and supporting your employees.