Market Overview

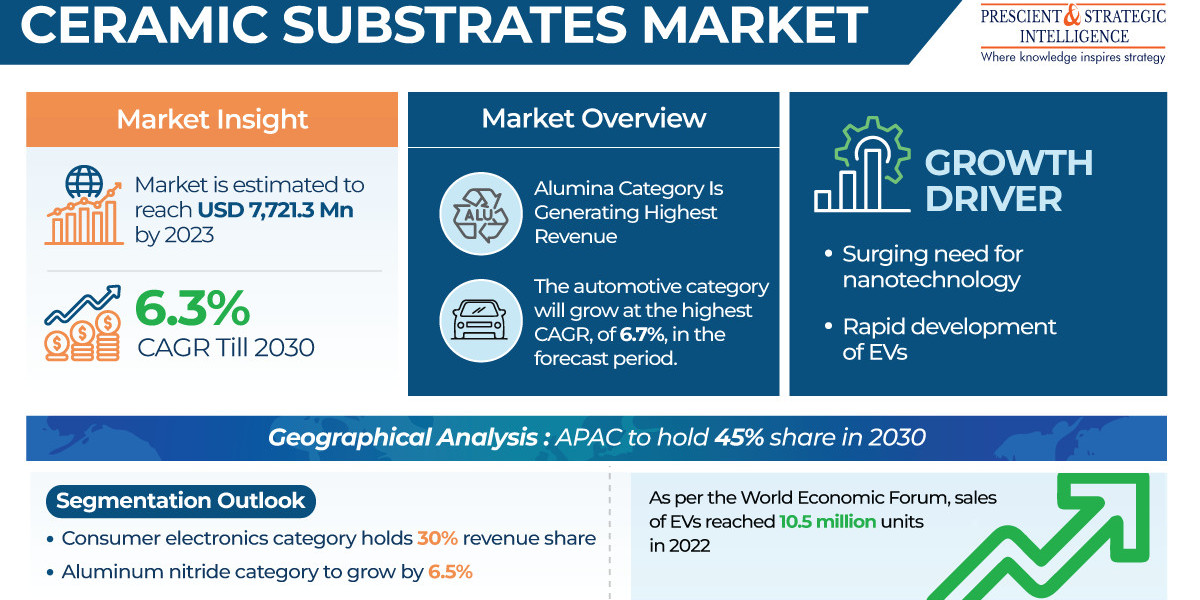

In 2023, the ceramic substrates industry is estimated to advance from a projected USD 7,721.3 million to USD 11,740.8 million by the end of the decade, at a CAGR of 6.3% over the forecast period. This growth of the market can be credited to the increasing demand for such materials in several sectors and the trend of the size reduction of electronic devices.

The need for compact yet dependable electronic equipment is being boosted by the fast technical enhancements, themselves propelled by research development. Also, as the semiconductor tech has enhanced, electronic devices are now capable of performing complex functions, which calls for the usage of hybrid circuits added into ceramic substrates.

The market is mainly driven by the increasing demand for such materials from a number of industries. Mainly, in the electrical & electronics sector, ceramic substrates are important in high-voltage power electronics. Moreover, the advancements in the microfabrication technology and surface science and the fast growth in the utilization of semiconductors are the key propellers for the industry.

The utilization of thin-film ceramic substrates has also substantially contributed to the downsizing of an extensive variety of electronic devices, such as video cameras, e-book readers, tablet PCs, cellphones, and video cameras, all of which consist of hybrid circuits. To these products, these substrates offer strong resistance to wear, temperature, and corrosion.

Key Insights

The alumina category generated the highest revenue in the product segment due to Al2O3 being the most-widely used advanced oxide ceramic material.

Alumina components are produced using injection molding, slip casting, isostatic pressing, uniaxial pressing, and extrusion.

Alumina's notable qualities include great hardness and strength, temperature stability, and resistance to corrosion and wear.

Alumina substrates are preferred in the electrical and electronics industry for their insulation properties and affordability.

The consumer electronics category held a 30% market share in the end-use segment in 2023.

Consumer electronics use ceramic substrates for packaging in gadgets like smartphones, gaming consoles, laptops, and tablets.

Ceramic substrates are essential for small-space packaging in devices like earbuds and hearing aids.

The automotive category will grow at the highest CAGR of 6.7% during the forecast period.

Ceramic substrates in the automotive industry are used in ABS, engine control units, airbag control modules, LEDs, and navigation systems.

LTCC and thin-film substrates are extensively used in vehicle electronics for their mechanical, dimensional, and thermal stability.

Ceramic substrates are crucial for EV and hybrid EV power modules due to their thermal conductivity and high-voltage isolation.

Sales of EVs reached 10.5 million units in 2022, a 55% increase from the previous year, driving demand for ceramic substrates.

APAC is dominating the market and is expected to hold a 45% share by 2030.

Increasing production and advancement of consumer electronics in India and China are key factors for APAC's market dominance.

The booming semiconductor industry and AI applications are driving the demand for ceramic substrates in APAC.

China's goal to be 70% self-sufficient in integrated circuit production by 2025 will boost the semiconductor industry and demand for ceramic substrates in the region.

Source: P&S Intelligence