Summary:

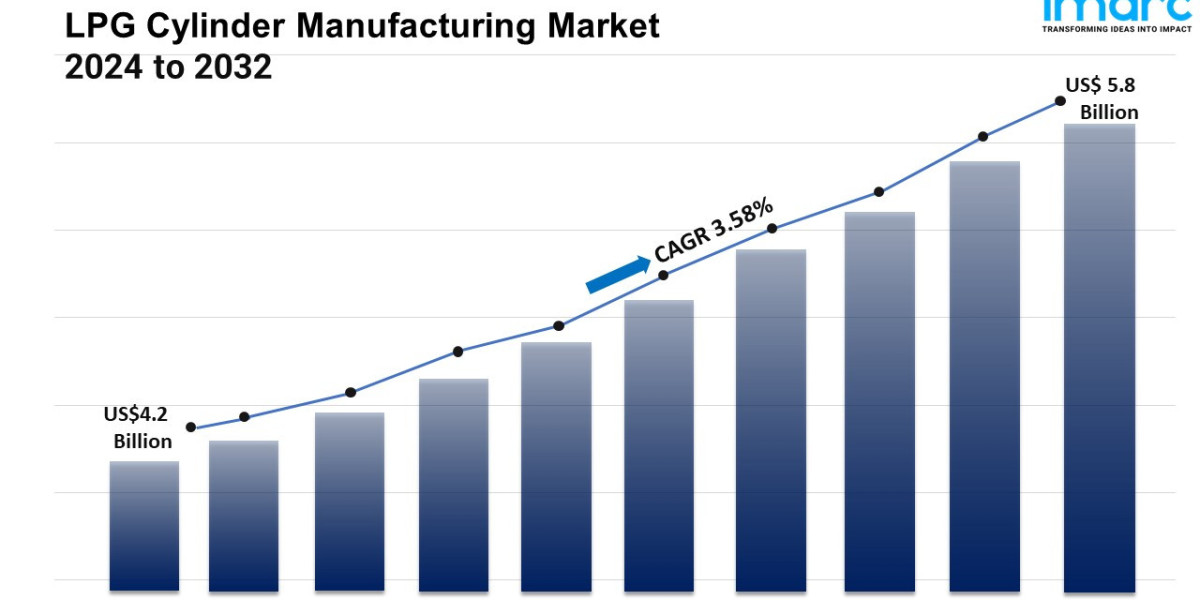

- The global LPG cylinder manufacturing market size reached USD 4.2 Billion in 2023.

- The market is expected to reach USD 5.8 Billion by 2032, exhibiting a growth rate (CAGR) of 3.58% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest LPG cylinder manufacturing market share.

- Steel accounts for the majority of the market share in the material segment due to its durability, strength, and high-pressure resistance, making it an ideal choice for LPG cylinder manufacturing.

- 4 Kg – 15 Kg holds the largest share in the LPG cylinder manufacturing industry.

- Domestic remain a dominant segment in the market as LPG cylinders are extensively used for household cooking and heating, especially in areas lacking piped gas infrastructure.

- The increasing demand for lightweight composite cylinders is a primary driver of the LPG cylinder manufacturing market.

- The LPG cylinder manufacturing market growth and forecast highlight a significant rise due to advancements in cylinder manufacturing technology.

Industry Trends and Drivers:

- Rising Demand for Lightweight Composite Cylinders:

The industry is experiencing several LPG cylinder manufacturing market trends such as inclination toward lightweight composite cylinders, which offer several advantages over traditional steel cylinders. Made from materials like fiberglass and plastic composites, these cylinders are significantly lighter, making them easier to transport and handle for consumers, especially in residential settings. The reduced weight is particularly beneficial in rural and remote areas, where transportation infrastructure may be limited, and consumers have to carry cylinders over long distances. Additionally, composite cylinders are resistant to rust and corrosion, providing a longer lifespan and improved safety. These cylinders often come with a transparent design that allows users to monitor the gas level, improving convenience and reducing the risk of unexpected fuel depletion. Governments and environmental agencies are also promoting the use of composite cylinders as they are more environmentally friendly, with lower emissions during production and disposal compared to steel. As consumers and regulators prioritize safety, convenience, and sustainability, the LPG cylinder manufacturing demand is expected to continue growing.

- Technological Advancements in Cylinder Manufacturing:

Technological advancements in LPG cylinder manufacturing are transforming the market, enabling manufacturers to improve production efficiency, quality, and safety. Automated welding and robotic assembly lines are becoming common in manufacturing plants, allowing for consistent and precise construction of LPG cylinders. These innovations enhance the durability and safety of cylinders and streamline production processes, reducing costs and minimizing human error. Additionally, new coating and painting technologies are improving the corrosion resistance of steel cylinders, extending their lifespan and reducing maintenance needs. Another key development is the use of advanced testing methods, such as ultrasonic and hydrostatic testing, which ensure cylinders meet safety standards before they reach consumers. These methods provide manufacturers with accurate data on each cylinder’s strength and integrity, further enhancing safety and reliability. The integration of smart technology, such as RFID tags, is also gaining traction, enabling tracking of cylinders throughout their lifecycle for better inventory management and safety monitoring. As manufacturers adopt these technologies, LPG cylinder manufacturing market share expands.

- Increasing Government Initiatives to Promote LPG Use:

Government initiatives worldwide are increasingly focused on promoting LPG as a cleaner alternative to traditional fuels, such as coal and kerosene, to reduce household air pollution and improve energy access. Many governments, particularly in developing regions, are providing subsidies, financial incentives, and educational campaigns to encourage households to switch to LPG for cooking and heating. In Asia Pacific, for instance, large-scale programs are being implemented to distribute LPG cylinders at subsidized rates, aiming to reach low-income households that rely on less efficient and more polluting fuels. These initiatives drive demand for LPG cylinders and encourage manufacturers to scale up production to meet the growing demand. Additionally, government regulations are strengthening safety and quality standards in cylinder manufacturing, compelling manufacturers to adopt higher standards and innovate to produce safer, more reliable products. The push for cleaner energy sources aligns with global efforts to combat climate change, making LPG a preferred option for domestic energy use. As governments continue to support LPG adoption, LPG cylinder manufacturing market size is expected to grow.

Request Sample For PDF Report: https://www.imarcgroup.com/lpg-cylinder-manufacturing-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Material Insights:

- Steel

- Aluminum

Steel accounts for the majority of shares due to its durability, strength, and ability to withstand high pressure, making it ideal for LPG cylinder manufacturing.

Size Insights:

- 4 Kg – 15 Kg

- 16 Kg – 25 Kg

- 25 Kg – 50 Kg

- More than 50 Kg

4 Kg – 15 Kg dominates the market as it meets the typical household demand for LPG, balancing portability with sufficient fuel capacity for domestic use.

End User Insights:

- Domestic

- Commercial

- Industrial

Domestic represents the majority of shares as LPG cylinders are widely used for cooking and heating in households, particularly in regions without piped gas infrastructure.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific holds the leading position owing to a large market for LPG cylinder manufacturing driven by high demand for LPG in households, rapid population growth, and government initiatives to promote LPG as a cleaner fuel alternative.

Top LPG Cylinder Manufacturing Market Leaders:

- Aygaz A.S.

- Confidence Petroleum India Limited

- ECP Industries Limited

- Hexagon Ragasco AS (Hexagon Composites ASA)

- Manchester Tank (McWane Inc.)

- Mauria Udyog Ltd.

- Sahamitr Pressure Container PLC

- Satyasai Pressure Vessels Group

- Shandong Huanri Group Co. Ltd.

- Worthington Industries Inc.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.