Construction workers are the backbone of any building project, whether it's a home renovation, a skyscraper, or a road construction project. They work hard every day to bring blueprints to life and ensure that structures are safe, secure, and long-lasting. However, despite their essential role in the economy, many construction workers face challenges when it comes to receiving clear and transparent payment details.

One of the most common struggles construction workers face is the lack of detailed pay information. Understanding how much they are being paid, what deductions are taken from their earnings, and how their hours are accounted for is crucial for financial planning and peace of mind. This is where a free paystub creator comes in.

A paystub creator is a tool that generates clear and professional paystubs for workers, giving them an easy way to see how their wages are calculated and ensuring that their pay is transparent. In this blog post, we will explore why construction workers need a paystub creator and how it can help provide transparency and prevent confusion when it comes to pay.

1. The Importance of Transparent Pay for Construction Workers

In the construction industry, workers often face irregular hours, varying job sites, and fluctuating pay depending on experience, location, and the type of work being done. This makes it essential for workers to have access to clear pay information. Transparent pay means that workers know exactly how much they earned, how much was deducted for taxes and other benefits, and how their final paycheck is calculated.

Unfortunately, not all employers provide detailed pay statements, and this lack of transparency can lead to confusion, disputes, and frustration. In some cases, workers might not fully understand why their pay is lower than expected or how their overtime pay is calculated. By using a paystub creator, construction workers can avoid these problems and ensure they are paid fairly for their hard work.

Benefits of Transparent Pay:

- Clarity: Workers can see exactly how their wages are calculated, including regular pay, overtime, bonuses, and deductions.

- Dispute Resolution: If there is ever a question about pay, having a detailed pay stub makes it easier to resolve the issue with the employer.

- Financial Planning: Transparent pay allows workers to better plan their personal finances, save money, and ensure they are saving for things like taxes or retirement.

- Tax Compliance: Clear paystubs also help workers keep track of how much they owe in taxes, reducing the risk of surprises during tax season.

2. How a Paystub Creator Works

A paystub creator is a simple tool that generates detailed pay stubs based on the information you provide. Workers can input their hours worked, hourly rate or salary, overtime hours, and any deductions (such as taxes, benefits, or union dues) into the creator, and it will automatically generate a professional pay stub.

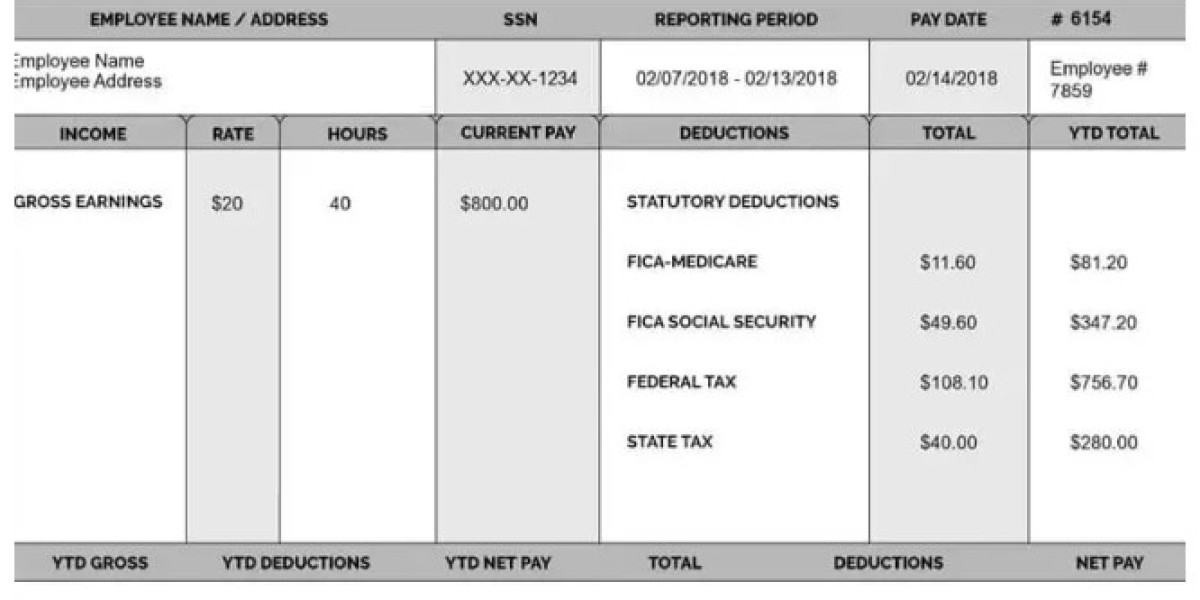

Here are some of the key components of a typical pay stub generated by a paystub creator:

- Employee Information: The worker's name, address, and employee ID.

- Employer Information: The employer's name, address, and contact details.

- Pay Period: The specific period during which the worker earned the wages.

- Earnings: This includes regular wages, overtime pay, bonuses, and any other earnings.

- Deductions: A breakdown of any taxes, insurance, retirement contributions, or other deductions from the worker's pay.

- Net Pay: The final amount the worker will take home after all deductions have been subtracted.

The paystub creator generates a clear and easy-to-understand document that can be printed or saved electronically. It eliminates the need for manual calculations, reducing the chances of errors and ensuring the worker’s pay is accurate.

3. Common Pay Issues in the Construction Industry

Construction workers often face specific challenges related to their pay that can be difficult to track without a paystub creator. These include:

A. Irregular Hours and Overtime

Construction projects often have tight deadlines, which means workers may need to put in extra hours. Overtime pay is usually required for hours worked beyond a certain threshold (e.g., 40 hours per week in many cases). However, calculating overtime pay can be tricky, especially for workers who may not know exactly how their employer is calculating it.

A paystub creator helps workers track overtime hours, ensuring they are paid correctly for the additional work they put in. With a paystub creator, workers can easily compare their expected pay with their actual earnings and quickly spot any discrepancies.

B. Variable Pay Rates

Some construction workers are paid different rates depending on their skills, experience, or the type of work being performed. For example, a skilled tradesperson might earn more per hour than a laborer. Without clear pay information, it can be difficult for workers to determine if their pay is accurate.

A paystub creator allows workers to input different pay rates for different types of work, ensuring that they are paid the correct amount based on the tasks they perform.

C. Temporary or Seasonal Work

Many construction workers are employed on a temporary or seasonal basis. This can make budgeting and financial planning more difficult, as pay may fluctuate depending on the season or project length. Having access to a paystub creator allows workers to track their earnings over time, making it easier to manage finances during the off-season.

D. Deductions and Benefits

Construction workers may have various deductions taken from their pay, such as taxes, health insurance premiums, retirement contributions, or union dues. Understanding these deductions is essential for workers to know how much of their earnings they can expect to take home. A paystub creator provides a detailed breakdown of these deductions, ensuring that there is no confusion.

4. How a Paystub Creator Promotes Fairness and Accuracy

One of the biggest benefits of using a paystub creator is that it ensures fairness and accuracy when calculating wages. Without clear paystubs, it can be difficult for workers to know if they are being paid correctly. Mistakes can happen, and if there is no transparent record of how pay is calculated, these errors can go unnoticed.

With a paystub creator, workers have a detailed, accurate record of their pay that they can refer to if there are any questions or concerns. This helps to prevent errors such as underpayment, missed overtime, or incorrect deductions.

A paystub creator also promotes fairness by allowing workers to track their earnings over time. If a worker believes they are not being paid fairly compared to industry standards or their colleagues, they can use their pay stubs to compare their pay rates and ensure they are being compensated appropriately.

5. The Benefits of Digital Paystubs for Construction Workers

In today’s digital age, many employers are moving away from paper-based paychecks and pay stubs in favour of digital solutions. This shift offers several advantages for construction workers:

A. Easy Access and Record-Keeping

Digital paystubs can be stored on a worker's computer or mobile device, making it easy to access and review pay information at any time. Workers no longer have to keep track of paper copies, reducing the risk of losing important documents. Additionally, digital paystubs are often easier to share with lenders, financial advisors, or government agencies if needed.

B. Faster and More Efficient

Digital paystub creators can generate paystubs instantly, reducing the time and effort it takes to create and distribute pay information. This is especially beneficial for construction workers who may be working on multiple job sites or managing different projects simultaneously.

C. Increased Security

Digital paystubs are often more secure than paper pay stubs, as they can be encrypted and protected with passwords. This reduces the risk of payment information being lost, stolen, or tampered with.

6. Conclusion

In an industry as fast-paced and variable as construction, workers need tools that can help them keep track of their earnings and ensure they are being paid fairly and accurately. The best paystub creator is an essential tool for construction workers who want transparency, fairness, and peace of mind when it comes to their pay.

By using a pay stub creator, construction workers can ensure that they have a clear record of their pay, track their hours, review their deductions, and resolve any disputes that may arise. With the added convenience and security of digital pay stubs, workers can also access their pay information on the go, making it easier to manage their finances and plan for the future.