Managing payroll for a large team is always a challenging task, but for hospitals, the complexity is often heightened by factors unique to the healthcare industry. Hospitals have numerous departments, employees working varied shifts, and different pay structures that must be handled accurately. A reliable paystub creator can be invaluable in managing these complexities, ensuring that payroll is handled efficiently, and employees receive clear, accurate pay documentation. This blog will explore the importance of paystub tools in hospital payroll management and why a specialized paystub creator can make a significant difference.

Why Payroll Management is Complex in Hospitals

Hospitals often operate around the clock, with staff working in multiple shifts that can vary in length and timing. Add to this the different types of healthcare professionals—such as doctors, nurses, technicians, administrative staff, and support personnel—and it becomes clear that a hospital’s payroll needs are far more complex than those of many other industries.

Some of the unique factors influencing payroll in hospitals include:

- Varied Shifts and Overtime: With multiple shifts and unpredictable overtime, payroll must track not only hours worked but any additional pay owed for overtime or shift differentials.

- Different Pay Rates: Employees in hospitals work in various roles with different pay rates, from salaried positions to hourly and per diem workers.

- Additional Earnings and Deductions: Many healthcare employees receive extra compensation, such as bonuses, hazard pay, or specific deductions for benefits and retirement funds.

These complexities make it crucial to use a robust paystub creator that can handle diverse payroll needs, offering clear, organized paystubs to employees who rely on transparency in their earnings.

The Role of a Paystub Creator in Hospital Payroll Management

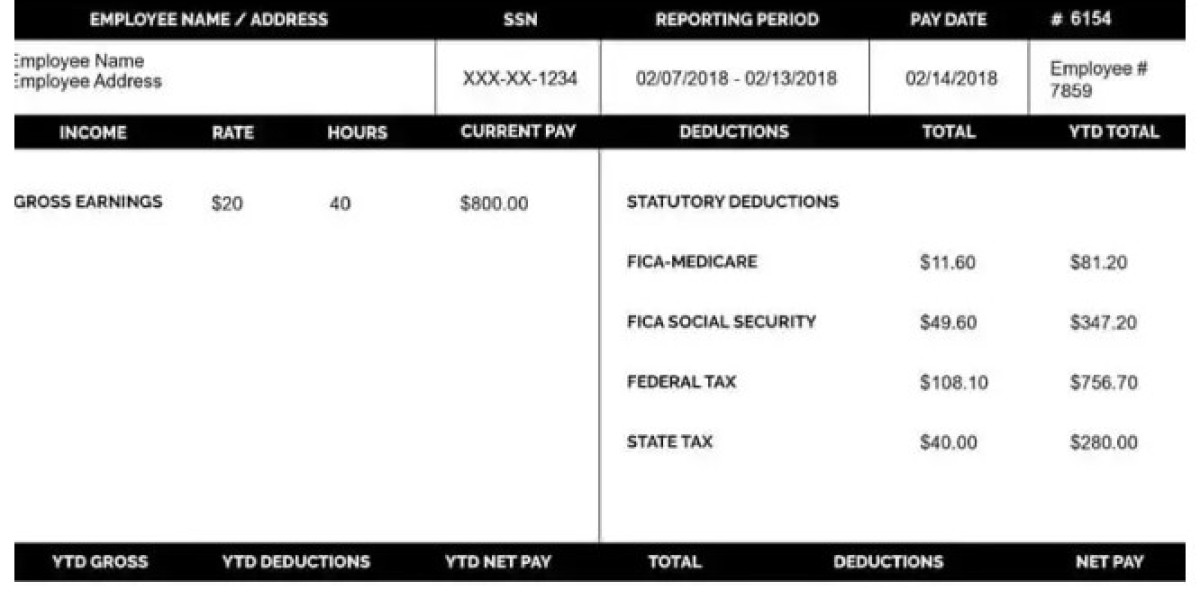

A paystub creator is an online tool that generates detailed, accurate paystubs for each employee. For hospitals, using a paystub creator is essential to manage and document payments for a large team effectively. It breaks down earnings, taxes, and deductions in a structured format, giving each employee a clear view of their compensation and any withholdings.

For hospitals, a paystub creator offers multiple benefits:

1. Organized and Transparent Documentation

Employees in healthcare settings often have questions about their earnings, especially when it comes to overtime pay, shift differentials, and deductions for healthcare and retirement benefits. A paystub creator provides transparency by offering an organized view of these details on each paystub, reducing payroll-related queries and helping employees understand their compensation.

2. Accurate Tracking of Overtime and Shift Differentials

In a hospital, employees may work irregular hours or be called in for additional shifts. Paystub tools can automatically calculate overtime rates and any shift differentials, ensuring that employees are paid accurately for their unique schedules. This reduces the risk of payroll errors and helps build trust with employees by providing accurate and fair compensation.

3. Streamlined Payroll for Diverse Employee Types

Hospitals employ a mix of full-time, part-time, contract, and per diem workers. Each employee type has specific payment structures and requirements. A specialized paystub creator can handle these differences with ease, automating the documentation of hours worked, contract terms, and relevant deductions based on employment type. This ensures that each employee receives a tailored paystub reflecting their individual pay structure.

Key Features of an Effective Paystub Creator for Hospitals

When choosing a paystub creator for hospital payroll management, it’s essential to look for tools with features that cater specifically to the healthcare industry’s needs. Here are some of the most important features to consider:

1. Customizable Fields for Deductions and Benefits

Hospital employees often have benefits such as health insurance, retirement savings plans, and union dues. A paystub creator that allows customization of these fields can provide a detailed breakdown of each deduction, ensuring clarity on where portions of their paycheck are going.

2. Automated Overtime and Shift Calculations

As mentioned, hospital employees frequently work beyond standard hours. An effective paystub tool should automate overtime calculations, applying the correct rates for night shifts, weekends, or holidays. This automation minimizes errors and ensures that employees are compensated accurately according to labor laws and hospital policies.

3. Multi-Department Integration

Hospitals are divided into multiple departments, each with its own payroll needs. A paystub creator that can integrate these departments and process payments accordingly helps streamline payroll management across the entire organization. This feature is especially valuable for payroll teams managing hundreds or thousands of employees across departments.

4. Easy Access and Digital Storage

Modern paystub tools often offer digital storage solutions, allowing employees to access and download their paystubs online. This feature is particularly helpful for hospital employees who may need their pay documentation for tax purposes, applying for loans, or tracking their finances. By offering digital access, hospitals can also reduce paper usage and create an environmentally friendly, easily accessible payroll system.

5. Compliance with Labor Laws

Hospitals must comply with various labor laws, including fair wage practices, overtime regulations, and employee tax withholdings. A reliable paystub creator is updated regularly to reflect any changes in these laws, ensuring that payroll remains compliant and reduces the risk of legal issues.

Benefits of Using a Paystub Creator for Hospital Employees

Not only does a paystub creator simplify payroll management for administrators, but it also offers significant benefits for hospital employees:

1. Enhanced Understanding of Earnings

Hospital employees often have complex pay structures, with differentials and variable hours. A detailed paystub helps them understand each aspect of their earnings, making it easier to manage personal finances and budget accurately.

2. Clear Insight into Deductions

Benefits deductions, tax withholdings, and retirement contributions can be confusing. A well-designed paystub provides a clear breakdown of each deduction, helping employees understand their total compensation package beyond just their take-home pay.

3. Financial Planning Support

Access to detailed pay stubs enables employees to make informed decisions about their finances. Whether they are applying for loans or managing family budgets, hospital employees benefit from having precise documentation of their earnings and deductions.

Steps for Implementing a Paystub Creator in Hospitals

For hospitals considering the implementation of a paystub creator, here are some steps to ensure a smooth transition:

1. Assess Payroll Needs

Hospitals should start by assessing the unique payroll needs of their teams, including overtime policies, differentials, and employee types. Identifying these specifics will help in selecting a paystub tool that meets all organizational requirements.

2. Choose a Reliable Paystub Creator Tool

There are numerous paystub creators available, but not all will meet the needs of a large, complex organization like a hospital. Choose a tool that offers robust customization options, is compliant with labor laws, and can manage high volumes of employees efficiently.

3. Integrate the Tool with Payroll Systems

To streamline operations, ensure that the paystub creator integrates with existing payroll software. This integration allows data to flow smoothly between systems, reducing the need for manual data entry and minimizing the chances of errors.

4. Provide Employee Training

Employees will need to understand how to access and interpret their pay stubs, especially if they contain complex information on deductions and differentials. Offering training or informational sessions can help employees navigate the new system and understand their pay documentation better.

5. Monitor and Adjust

Once implemented, monitor the paystub creator's performance and gather feedback from employees and payroll staff. This feedback can guide any necessary adjustments to improve the tool’s effectiveness and ensure it continues to meet the hospital’s payroll needs.

Addressing Common Challenges with Paystub Tools in Hospitals

Using a paystub creator can simplify payroll, but hospitals may still face challenges during implementation. Here are some common issues and solutions:

Data Security Concerns: Given the sensitive nature of payroll data, hospitals should ensure that their paystub tool uses encryption and complies with data privacy regulations to protect employee information.

Complex Pay Structures: Hospitals should ensure that the paystub creator they choose has the flexibility to handle various pay structures and adjustments. Choosing a customizable tool can mitigate this challenge.

Employee Adaptation: Introducing new tools can require an adjustment period. Offering support and guidance can help employees understand the benefits and learn how to use the new paystub system.

Conclusion: Why Paystub Tools are Essential for Hospital Payroll Management

For hospitals, using a free paystub creator simplifies the complexities of payroll, allowing administrators to provide detailed, accurate pay stubs that clarify earnings and deductions for employees. By handling unique challenges such as shift differentials, overtime, and benefits deductions, paystub tools ensure that hospital staff are compensated fairly and transparently. In an environment where accuracy and clarity are critical, a paystub creator is not only an efficient payroll solution but also a tool that enhances trust and support between the hospital and its employees.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs