As the world becomes increasingly digital and work-from-home opportunities grow, remote workers need reliable tools to manage their finances. One of the most important tools for any employee, especially remote workers, is a free paycheck calculator. A paycheck calculator helps you quickly calculate your gross pay, deductions, and net pay without the need for complicated software or manual calculations. This tool is especially valuable for remote workers who may be working for companies across different states or even countries, making it difficult to track pay stubs or tax rates.

In this guide, we’ll explore how remote workers can use a free paycheck calculator to save time, avoid errors, and manage their finances more effectively. We’ll also cover how to use these calculators, the benefits they offer, and some tips on making the most of them. So, whether you're a remote worker, freelancer, or gig economy participant, read on to discover how to streamline your payroll and ensure you're always on top of your finances.

What is a Free Paycheck Calculator?

A free paycheck calculator is an online tool that helps you calculate your take-home pay after taxes and other deductions. The calculator works by using your pay rate (hourly or salary), tax deductions, and other factors like insurance, retirement contributions, and benefits to determine how much you will actually receive after all the deductions are made.

For remote workers, a paycheck calculator is a powerful tool that can quickly and accurately give you a breakdown of your income without relying on payroll software or manual calculations. The best part? These calculators are free to use, so you can access them whenever you need to check your paycheck details.

Why Remote Workers Need a Free Paycheck Calculator

For remote workers, especially those working for companies based in different states or even countries, keeping track of taxes and deductions can be complex. Here are some reasons why using a free paycheck calculator is essential for remote workers:

1. Varied Tax Rates

Remote workers often work for companies that may not have payroll offices in the state they live in. This means that taxes and other deductions can vary significantly depending on where you live. A free paycheck calculator helps you understand how much you’ll owe in taxes by taking into account federal, state, and local tax rates.

2. Simplified Deductions

As a remote worker, you may have several deductions that affect your paycheck, such as retirement contributions, health insurance premiums, or home office deductions. A paycheck calculator ensures that these deductions are accurately calculated, helping you avoid surprises when you get your pay stub.

3. Budgeting and Financial Planning

Knowing exactly how much you will take home from your paycheck helps with budgeting and financial planning. Remote workers, who may not have access to the same benefits as in-office workers, can use a paycheck calculator to estimate how much money they will have after taxes and deductions, helping them plan for expenses more effectively.

How to Use a Free Paycheck Calculator

Using a free paycheck calculator is simple and straightforward. Below is a step-by-step guide on how you can use these tools to calculate your paycheck:

Step 1: Find a Reliable Paycheck Calculator

There are many free paycheck calculators available online. Be sure to choose one that is reputable and offers accurate calculations based on your location, tax filing status, and other details. Look for a calculator that allows you to input federal and state tax information, as well as deductions like retirement contributions, healthcare, and other benefits.

Step 2: Enter Your Personal Information

Once you've selected a paycheck calculator, the next step is to input your personal details. These typically include:

- Pay type: Are you paid hourly or salaried? If you’re hourly, you’ll need to input your hourly rate and the number of hours worked per week or pay period.

- Tax filing status: Are you filing as single, married, head of household, etc.? This will affect your federal and state tax calculations.

- State of residence: Tax rates vary by state, so you'll need to enter the state where you live.

- Additional deductions: These could include retirement plan contributions, healthcare premiums, union dues, or other benefit-related deductions.

Step 3: Input Your Pay Details

For salaried workers, input your annual salary. For hourly workers, input your hourly wage and the number of hours you work per week or pay period. Be sure to also include any overtime, commissions, or bonuses if applicable.

Step 4: Review Your Deductions

The calculator will typically allow you to input deductions, such as federal and state taxes, Social Security, Medicare, and any other personal deductions you may have, like retirement contributions or health insurance premiums. The calculator will use the most up-to-date tax rates for your location to ensure accurate results.

Step 5: Generate Your Paycheck

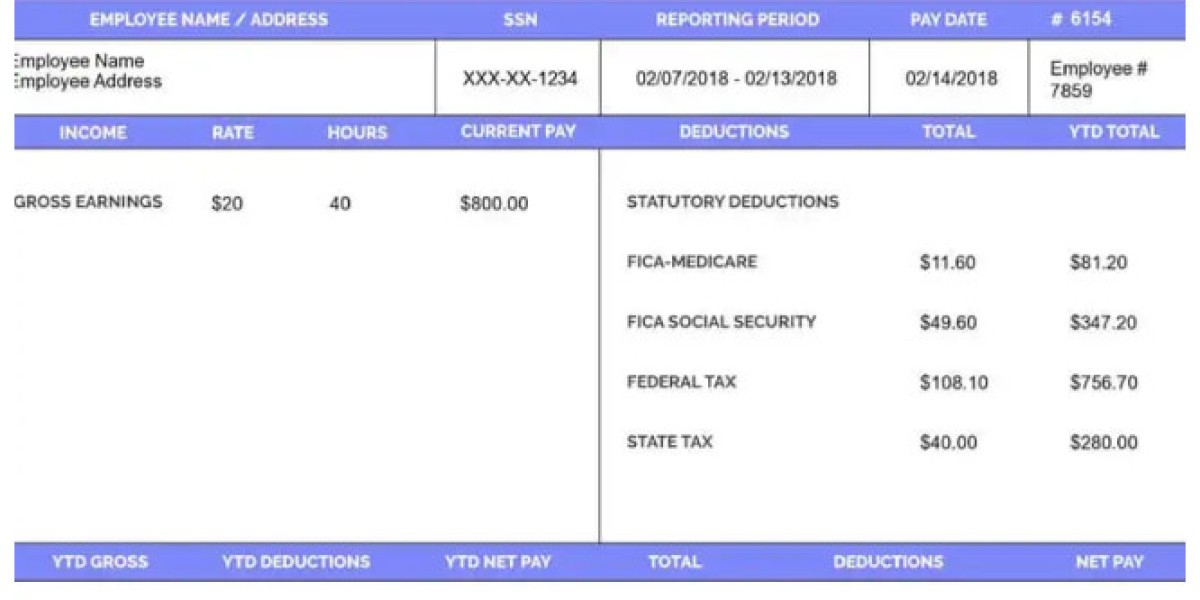

After entering all your details, click on the "Calculate" or "Generate" button. The calculator will give you a breakdown of your paycheck, showing your gross pay (before deductions), your deductions (taxes, benefits, etc.), and your net pay (the amount you take home).

Step 6: Save or Print Your Results

Once you’ve generated your paycheck, you can usually save or print the results for future reference. Some calculators will also provide a detailed report or pay stub that you can use for record-keeping or budgeting.

Benefits of Using a Free Paycheck Calculator for Remote Workers

A free paycheck calculator offers many benefits to remote workers. Here’s why you should start using one today:

1. Accurate Tax Calculations

As mentioned earlier, one of the most important benefits of using a paycheck calculator is its ability to calculate taxes accurately. Remote workers may be subject to different tax rates depending on their state or city of residence. A paycheck calculator will take these variables into account, ensuring that your tax deductions are correct and that you are not overpaying or underpaying.

2. Save Time

Manually calculating your pay stub can be a time-consuming process. With a paycheck calculator, you can get an accurate estimate of your earnings in just a few minutes. This is especially helpful for remote workers who may not have direct access to an in-house payroll team.

3. Easy Budgeting

Knowing your exact take-home pay is crucial for creating a budget. With a paycheck calculator, remote workers can quickly see how much money they will have left after taxes and deductions. This can help you plan for bills, savings, and discretionary spending.

4. No Need for Expensive Software

Many payroll services can be expensive and require a subscription. A free paycheck calculator gives remote workers the same functionality without the cost. Whether you're freelancing, contracting, or working as an employee for a remote company, using a free calculator ensures you don’t have to invest in costly payroll software.

5. Remote Work Flexibility

With remote work becoming more common, it’s likely that you will work with clients or employers in different time zones or states. A paycheck calculator allows you to quickly adjust to the various pay rates, taxes, and deductions that may apply based on your remote working situation.

Tips for Remote Workers Using a Free Paycheck Calculator

While paycheck calculators are easy to use, here are some tips to get the most out of them:

1. Double-Check Your Deductions

Some deductions, such as health insurance or retirement contributions, may vary based on your employer or contract. Always ensure that you input the correct information to get an accurate paycheck calculation.

2. Understand Your Tax Obligations

If you’re working in a different state than your employer, it’s important to know which taxes apply. Some states have no income tax, while others may have specific tax rates. A paycheck calculator can help clarify these differences.

3. Use Multiple Calculators for Comparison

Not all paycheck calculators are created equal. If you’re unsure about a calculation, use more than one free tool to verify your results. This can help you catch any errors or inconsistencies.

4. Consider Future Tax Changes

Tax rates can change over time. Be sure to update your calculator with the latest tax information each year to ensure your paycheck calculations are as accurate as possible.

Conclusion

For remote workers, managing payroll and understanding your paycheck can be complicated, especially with varying tax rates and deductions. A free paycheck calculator simplifies this process by providing you with a quick, accurate breakdown of your pay, helping you manage your finances more effectively. By using a paycheck calculator, you can save time, ensure accuracy, and avoid financial mistakes.

Whether you're a freelancer, contractor, or employee working remotely, this tool can help you navigate the complexities of paychecks and taxes without the need for expensive software.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?