Russia Commercial Insurance Market Overview

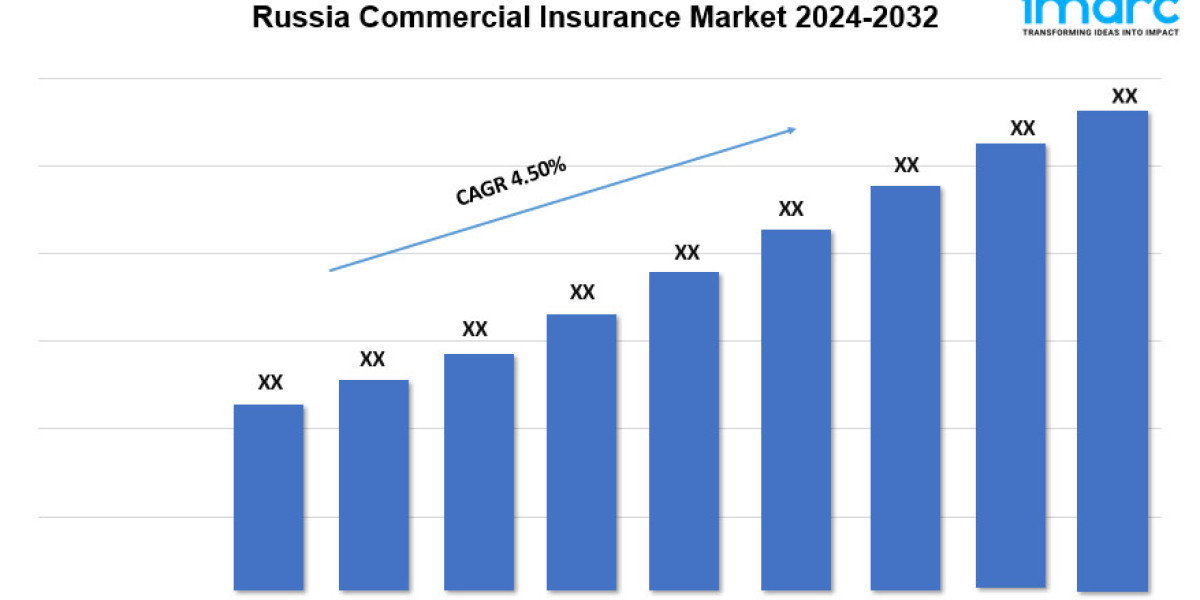

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 4.50% (2024-2032)

The Russia commercial insurance market is driven by increasing business activities, regulatory reforms, and rising awareness of risk management solutions. According to the latest report by IMARC Group, The Russia commercial insurance market is projected to exhibit a growth rate (CAGR) of 4.50% during 2024-2032.

Grab a sample PDF of this report: https://www.imarcgroup.com/russia-commercial-insurance-market/requestsample

Russia Commercial Insurance Industry Trends and Drivers:

The Russia commercial insurance market is influenced by a range of dynamic factors, reflecting the country's economic, political, and regulatory environment. A key driver is the evolving economic landscape, which is driving the demand for various insurance products. With Russia being a resource-rich country, fluctuations in oil and gas prices can have significant effects on the commercial sector. When oil prices are high, businesses, particularly in energy and natural resources, experience growth, thereby increasing their need for insurance coverage to protect against operational risks, property damage, and liability. Another important factor is the regulatory environment, which is undergoing reforms aimed at increasing market transparency and stability. The Russian government is introducing measures to enhance the solvency and reliability of insurance companies, such as stricter capital requirements and enhanced reporting standards. These regulations aim to build consumer confidence and attract more businesses to purchase insurance. Additionally, the implementation of the Federal Law on Insurance in Russia provides a clearer legal framework, which helps mitigate risks associated with insurance contracts and claims.

The growing complexity of business operations and the rising number of sophisticated risks is also positively influencing the market. As Russian companies are expanding and diversifying their operations, they face new and complex risks, including cyber threats, environmental liabilities, and supply chain disruptions. The increasing prevalence of digitalization and technology adoption in Russian businesses is driving the demand for cyber insurance and other specialized coverage options that address these emerging risks. This trend is reflective of a global shift where companies are seeking insurance solutions that cater to modern operational challenges. International sanctions imposed on Russia are impacting foreign investments and trade relationships, which, in turn, affect the insurance needs of businesses operating in Russia. Companies are seeking more comprehensive insurance solutions to manage risks associated with political and economic uncertainties. Additionally, domestic companies are facing challenges in securing reinsurance and accessing global insurance markets, prompting a greater reliance on local insurers and innovative insurance products.

We explore the factors propelling the Russia Commercial Insurance market growth, including technological advancements, consumer behaviors, and regulatory changes.

Russia Commercial Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145