Payroll fraud is a serious issue that can have significant financial and legal consequences for businesses. It not only affects the company’s bottom line but also damages employee trust and can harm its reputation. As businesses grow and evolve, so do the challenges of managing payroll efficiently and securely. One of the key players in reducing payroll fraud is the paycheck creator or payroll software. In this blog, we will explore the role of paycheck creators in preventing payroll fraud and how they can help businesses maintain accuracy, transparency, and security in their payroll processes.

Understanding Payroll Fraud

Before we dive into the role of paycheck creators, it's essential to understand what payroll fraud is. Payroll fraud occurs when someone intentionally manipulates the payroll system to illegally gain extra wages or benefits. This can be carried out by employees, managers, or even external parties who have access to the payroll system.

Common types of payroll fraud include:

- Ghost employees: These are non-existent employees who are added to the payroll system, with wages paid out to a fraudster.

- Overtime abuse: Employees or supervisors may falsify overtime hours to receive higher pay.

- Inflated work hours: Employees may falsely report their work hours to get paid more than they actually worked.

- Misclassification of employees: Some workers may be misclassified as independent contractors or exempt employees to avoid paying overtime or other benefits.

These fraudulent activities not only result in financial loss but can also lead to legal problems, reputational damage, and a loss of employee morale. This is where paycheck creators come in.

What is a Paycheck Creator?

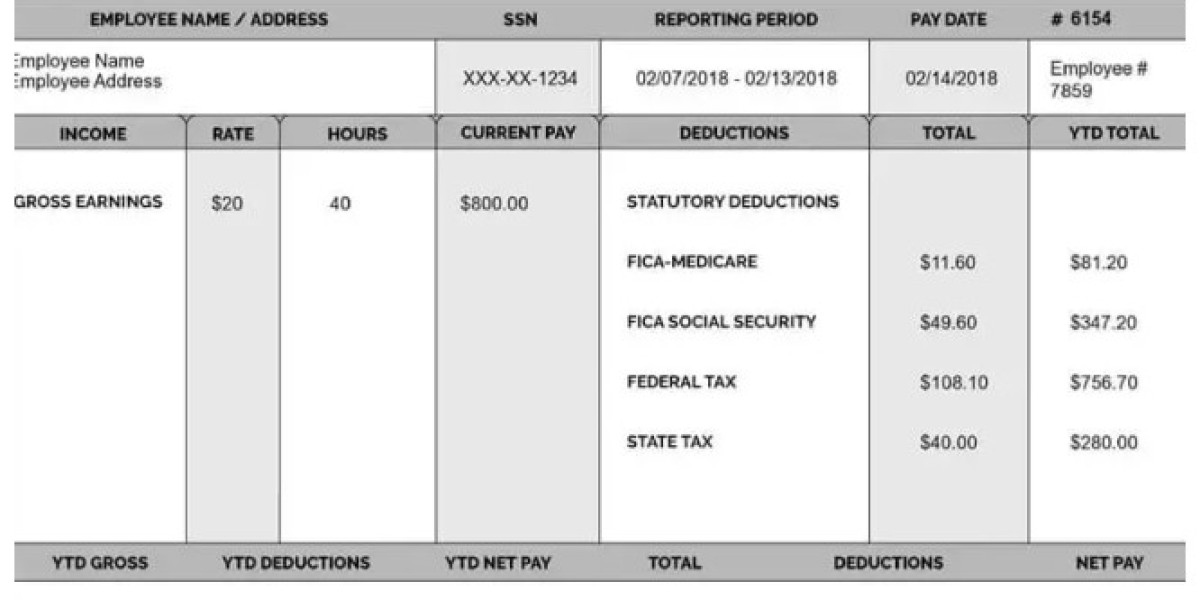

A paycheck creator, also known as payroll software, is a tool that helps businesses generate accurate paychecks for employees. These systems are designed to automate various payroll functions, such as calculating wages, deducting taxes, and issuing payments. In addition to simplifying payroll tasks, modern paycheck creators have built-in security features that reduce the risk of payroll fraud.

Paycheck creators can be cloud-based or on-premise software, and they cater to businesses of all sizes. They allow payroll administrators to enter employee data, set up pay schedules, and apply benefits or tax withholdings accurately. Many paycheck creators also integrate with other business systems like time tracking, HR management, and accounting software to ensure smooth operations.

How Paycheck Creators Reduce Payroll Fraud

Paycheck creators play a crucial role in minimizing payroll fraud by ensuring greater transparency, accuracy, and accountability in payroll management. Below are how paycheck creators help businesses reduce payroll fraud:

1. Automated Calculations

One of the most effective ways paycheck creators reduce fraud is by automating the calculation of wages, taxes, and deductions. Manual payroll calculations are prone to human errors, which can be exploited by individuals trying to manipulate the system. Automated payroll systems eliminate this risk by ensuring that every paycheck is calculated according to pre-set rules, including tax rates, benefits deductions, and overtime.

By automating these calculations, paycheck creators reduce the chances of fraudulent payroll activities such as over-reporting work hours or incorrectly classifying employees.

2. Real-Time Tracking of Employee Hours

Paycheck creators often integrate with time-tracking software that monitors employees' work hours in real-time. This integration ensures that employees can’t falsely report their hours without being caught. For instance, if an employee claims to have worked more hours than recorded by the time-tracking system, the discrepancy will be flagged, helping to prevent fraud.

Additionally, some paycheck creators use biometric or card-swiping systems to track employee attendance. These methods add another layer of security, making it harder for employees to falsify their work hours.

3. Audit Trails and Reporting

Most modern paycheck creators include audit trails, which track every change made within the payroll system. If a payroll administrator or employee alters any data, an audit trail records the change, including who made the change and when it occurred. This transparency helps identify unauthorized activities and ensures that any discrepancies are detected early.

Furthermore, paycheck creators offer detailed reports that allow businesses to review payroll data regularly. Regular audits and reviews of these reports can help employers spot irregularities, such as inflated overtime hours or unauthorized pay increases, and take action before they escalate into significant issues.

4. User Access Control

Another important feature of paycheck creators is their ability to control user access. Different employees can be given varying levels of access to the payroll system. For example, payroll administrators might have full access to make changes, while other staff members only can view reports.

By restricting access based on roles, businesses can prevent unauthorized individuals from tampering with payroll data. This feature is especially valuable in preventing payroll fraud committed by employees or supervisors with malicious intent.

5. Direct Deposit and Electronic Payment Methods

Paycheck creators also support direct deposit and other electronic payment methods, reducing the chances of check fraud. With direct deposit, wages are transferred directly into an employee’s bank account, eliminating the risk of payroll checks being stolen, altered, or forged. Direct deposit is not only more secure but also more convenient for employees.

Additionally, paycheck creators can be set up to automatically issue payments on specific dates, reducing the opportunity for payroll fraud by ensuring employees are paid on time and accurately.

6. Compliance with Tax Regulations

Paycheck creators are updated regularly to reflect the latest federal, state, and local tax laws. This ensures that employees are correctly taxed, and employers avoid penalties for tax-related mistakes. Misreporting taxes can sometimes be an intentional act of fraud, but a reliable paycheck creator ensures compliance with all tax regulations, reducing the chances of fraud.

Benefits Beyond Fraud Prevention

In addition to reducing payroll fraud, paycheck creators offer several other benefits to businesses. These include:

- Increased Efficiency: Automating payroll processes saves time and effort, freeing up resources for other critical tasks.

- Cost Savings: By reducing payroll errors and fraud, businesses can save money on fines, penalties, and unnecessary administrative costs.

- Improved Employee Satisfaction: With accurate and timely payments, employees feel valued and secure in their positions, boosting morale and retention.

Conclusion

Payroll fraud is a serious risk for any business, but Free Paycheck Creator plays an important role in mitigating this risk. By automating payroll calculations, tracking work hours, providing audit trails, and offering secure payment options, paycheck creators help businesses maintain an accurate and fraud-resistant payroll system.

Investing in a reliable paycheck creator is one of the most effective ways a business can protect itself from payroll fraud while improving operational efficiency and employee satisfaction. For businesses of any size, the security and accuracy provided by paycheck creators are invaluable assets in creating a trustworthy payroll process.