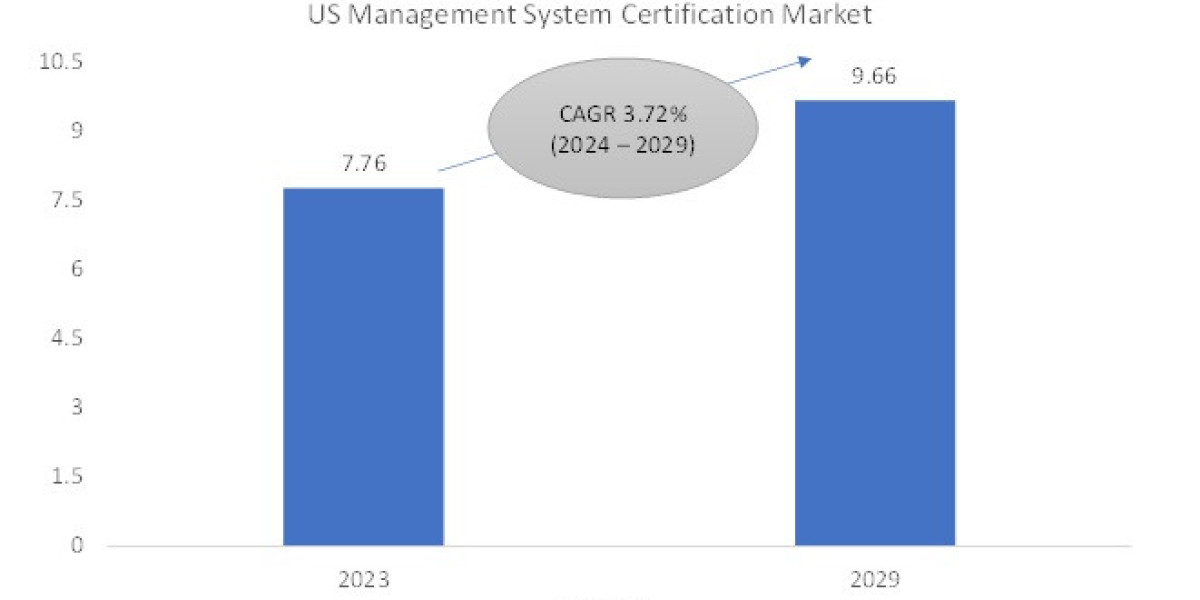

The US Management System Certification market is projected to grow from USD 7.76 billion in 2023 to reach USD 9.65 billion by 2029; it is expected to grow at a CAGR of 3.72% from 2024 to 2029.

Overview of the US Management System Certification Market

The United States management system certification market represents a significant portion of the global certification landscape, driven by the country’s diverse industrial base and robust regulatory environment. In 2023, the US accounted for a remarkable 70.9% share of the North American market. With its highly developed IT, telecommunications, automotive, and medical device sectors, the US remains a hub for companies seeking to align their operations with global standards. Certification processes like ISO 9001 for quality management and ISO 27001 for information security are vital for companies to enhance operational efficiency, ensure data security, and maintain global competitiveness.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=202845337

Demand Drivers for Management System Certification in the US

Several factors fuel the growth of the management system certification market in the US. One primary driver is the rapid expansion of industries that require stringent certification standards. For instance, the IT and telecommunications sectors, led by companies like AT&T and Verizon, consistently demand certified systems to guarantee service reliability and compliance with industry regulations. Similarly, the automotive industry's shift toward electric vehicles (EVs) and smart grid systems has significantly boosted the need for automation and energy efficiency certifications. Additionally, the country’s strong medical device manufacturing sector relies heavily on certification services to meet FDA and global compliance standards, ensuring patient safety and fostering innovation. These factors collectively underline the critical role of certifications in supporting industrial growth and risk mitigation.

Laws and Regulations Shaping the US Market

The regulatory framework in the US strongly supports the adoption of management system certifications across various sectors. Compliance with international standards such as ISO 14001 for environmental management and ISO 45001 for occupational health and safety is often mandated by federal and state-level agencies. For example, government-backed initiatives like the Clean Energy Plan encourage companies to adopt energy-efficient practices, indirectly driving demand for ISO 50001 (energy management). Furthermore, strict cybersecurity regulations such as the NIST Cybersecurity Framework incentivize firms to adopt certifications like ISO 27001 to bolster their information security measures. This regulatory rigor ensures that companies operating in the US maintain high operational and ethical standards while fostering trust among consumers and stakeholders.

The Impact of Generative AI on Certification Processes

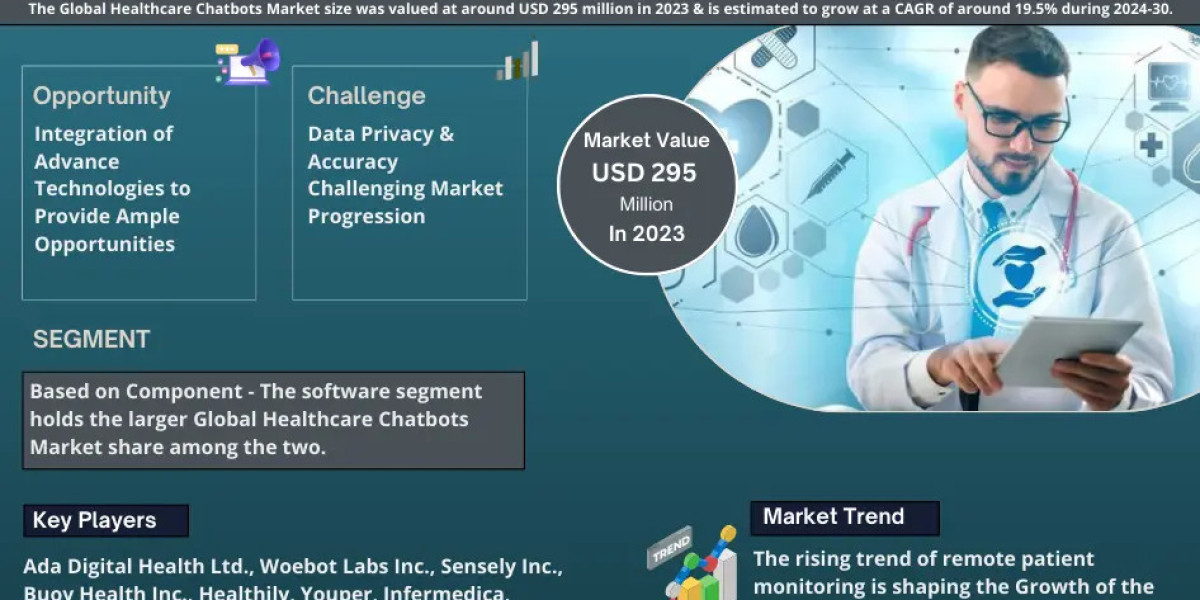

Generative AI (Gen AI) is emerging as a transformative force in the US management system certification market. AI-driven platforms are revolutionizing auditing and compliance by automating repetitive tasks, such as document verification and risk analysis, which traditionally required significant time and manual effort. AI tools now allow organizations to simulate compliance scenarios, predict potential non-conformities, and address gaps proactively. For instance, in sectors like telecommunications and healthcare, Gen AI enhances certification accuracy by analyzing vast datasets for anomalies in operational workflows. Additionally, AI-powered chatbots and virtual assistants are improving customer support by addressing queries regarding certification processes, timelines, and compliance requirements. However, the integration of AI also necessitates updates to existing certification standards, as organizations must ensure AI systems themselves adhere to ethical guidelines and data privacy laws.

Challenges Facing the US Certification Market

Despite its growth prospects, the US management system certification market faces several challenges. High certification costs remain a significant barrier, particularly for small and medium enterprises (SMEs) seeking to compete on a global stage. Additionally, the dynamic nature of technology creates challenges for maintaining up-to-date standards; for instance, rapid advancements in AI and IoT require frequent revisions of existing certifications. Another critical issue is data security and privacy concerns, particularly in sectors handling sensitive consumer information, such as healthcare and financial services. Finally, the increasing complexity of international trade regulations complicates the certification landscape, as companies must navigate both domestic and global standards. These challenges underscore the need for innovation in certification processes and policies to maintain market growth and relevance.