In the world of business, one of the most important tasks is ensuring that employees are paid accurately and on time. Traditionally, businesses have relied on paper-based payroll systems, manually calculating wages, deductions, and taxes. This process, while effective in its time, is becoming increasingly outdated in today’s fast-paced, technology-driven world. Enter the paystub creator—a digital solution that is changing how businesses manage their payroll and transforming operations across the board.

In this article, we will explore how transitioning from paper-based payroll systems to using a paystub creator can significantly benefit your business. We’ll look at how this tool works, its benefits, and why businesses of all sizes—whether you’re a small startup or a large corporation—should consider making the switch to digital pay stubs.

What is a Paystub Creator?

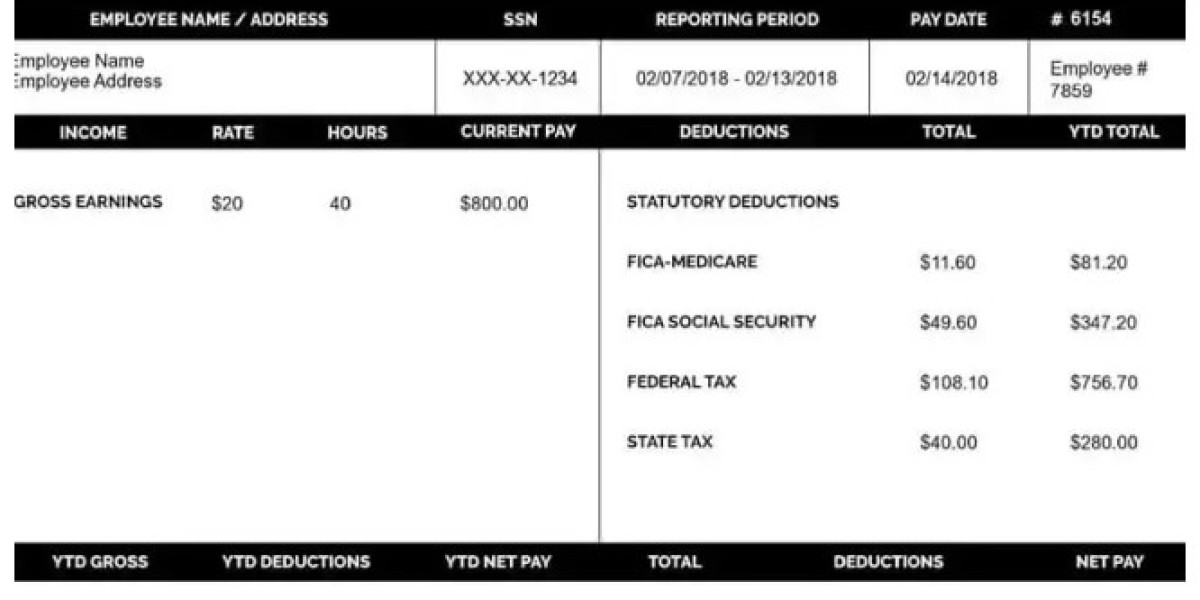

A paystub creator is an online tool or software that allows businesses to easily generate pay stubs for their employees. A pay stub is a document that provides a detailed breakdown of an employee’s earnings for a specific pay period. It includes information such as gross pay, deductions (e.g., taxes, insurance), net pay, and other relevant details. A paystub creator automates the process of generating these pay stubs, making the task quicker, more accurate, and more professional than traditional paper methods.

Paystub creators are typically simple to use. Business owners or managers can input key data such as the employee’s name, hourly rate, hours worked, deductions, and other relevant information, and the software will instantly generate a detailed, accurate pay stub. Many tools also allow for customization, enabling businesses to include company logos, specific deductions, and more.

Why Make the Switch from Paper to Digital?

The shift from paper-based systems to digital solutions has already transformed many aspects of business operations. From accounting to project management, technology has provided tools that increase efficiency, reduce errors, and improve overall workflow. Payroll is no different. Below, we’ll highlight some of the most compelling reasons why switching from paper to digital pay stubs using a paystub creator is beneficial for your business.

1. Time Savings

One of the biggest challenges with paper-based payroll systems is the amount of time it takes to manually create and distribute pay stubs. For a small business with just a few employees, this might seem manageable. But as your business grows and you hire more people, the time spent on payroll tasks can add up quickly.

A paystub creator drastically cuts down on the time it takes to generate pay stubs. Instead of manually calculating hours worked, deductions, and other details, the software automates these tasks, allowing you to generate a pay stub in minutes. This time-saving benefit is particularly helpful for small business owners who are juggling multiple tasks. It allows you to focus on other important aspects of your business without sacrificing payroll accuracy.

2. Accuracy and Compliance

Manual payroll systems are prone to errors—simple mistakes like entering incorrect hours or miscalculating deductions can result in underpayments or overpayments, which can lead to employee dissatisfaction and legal issues. The paystub creator eliminates the possibility of human error by automating calculations and ensuring that all the necessary deductions (like taxes, insurance, and retirement contributions) are applied correctly.

In addition, tax laws and payroll regulations can change frequently. A paystub creator often includes updates to tax tables and other legal requirements, ensuring that your business remains compliant with federal, state, and local tax laws. By using a paystub creator, you can rest assured that your pay stubs are accurate and compliant with all current regulations.

3. Cost Savings

Managing payroll manually can be expensive. Hiring a payroll specialist, purchasing payroll software, or paying for paper and ink can add up over time. For small businesses, these costs can quickly become a burden.

A paystub creator, on the other hand, is an affordable solution that provides significant cost savings. Many paystub creators offer subscription-based pricing, where you pay a low monthly fee for access to the tool. This is much more budget-friendly than paying for paper, stamps, and other physical resources. Plus, by reducing the need for manual calculations, you can save on labor costs associated with payroll management.

4. Professional and Organized Appearance

When you use a paystub creator, the resulting pay stubs look professional and polished. Unlike handwritten or spreadsheet-generated pay stubs, digital pay stubs from a paystub creator have a clean, easy-to-read format. This not only enhances your company’s image but also provides employees with a clear, organized breakdown of their earnings and deductions.

Professional pay stubs help build trust with employees. When workers receive accurate, well-formatted pay stubs, they feel confident in the company’s ability to handle payroll. Additionally, digital pay stubs are more secure than paper pay stubs. They can be sent via email or accessed through an employee portal, reducing the risk of lost or stolen documents.

5. Ease of Access and Storage

One of the most significant advantages of using a paystub creator is the ability to store pay stubs digitally. Instead of keeping physical records of pay stubs, which can easily get lost or damaged, you can store them securely in the cloud or on your computer. This digital storage makes it much easier to organize and access pay stubs when you need them.

For example, during tax season, it’s much more efficient to access digital pay stubs than to dig through piles of paper. You can quickly download and print past pay stubs as needed. Digital records also help ensure that you comply with legal requirements for record retention, making it easy to provide documentation if requested by government agencies.

6. Customization and Flexibility

Every business has its own unique payroll needs. A paystub creator provides flexibility by allowing you to customize the pay stubs to meet those needs. You can include your company’s logo, adjust the layout, or add custom fields for specific deductions or bonuses.

For example, if your employees receive commissions or tips in addition to their regular wages, you can easily add these details to the pay stub. This customization ensures that the pay stubs reflect the exact compensation structure of your business and make the process transparent for your employees.

Who Can Benefit from a Paystub Creator?

While every business can benefit from using a paystub creator, certain groups stand to gain the most from making the switch from paper to digital.

1. Small Business Owners

Small businesses are often short on time and resources. Paystub creators streamline payroll processing, saving business owners valuable time and energy. With fewer employees to manage, small business owners may think they don’t need complicated payroll software, but the simplicity and efficiency of a paystub creator can make a world of difference.

2. Freelancers and Contractors

Freelancers and independent contractors also need to provide clients with clear, professional invoices and pay stubs. A paystub creator allows them to easily generate pay stubs for their clients, ensuring that they receive prompt, accurate payment. It also helps freelancers stay organized and manage their finances more effectively.

3. Growing Businesses

As businesses grow and expand, payroll becomes more complex. Tracking multiple employees, different pay rates, and various deductions can be overwhelming. A paystub creator automates many of these tasks, making it easier for business owners to handle payroll without getting bogged down in paperwork.

4. HR Professionals and Payroll Managers

HR professionals and payroll managers in larger organizations can also benefit from using a paystub creator. The software can help automate the generation of pay stubs, saving HR teams significant time. It also ensures that pay stubs are accurate and consistent, improving the efficiency of payroll departments.

How to Choose the Right Paystub Creator for Your Business

When selecting a paystub creator for your business, it’s important to consider the following factors:

Ease of Use: Look for a paystub creator that is user-friendly and easy to navigate. It should allow you to quickly input employee data and generate pay stubs without any hassle.

Customization Options: Choose a paystub creator that allows you to customize the pay stubs with your company’s logo, specific deductions, and other relevant details.

Compliance: Ensure that the paystub creator is up to date with the latest tax laws and payroll regulations. This will help you avoid compliance issues and ensure your pay stubs are legally correct.

Security: Make sure the paystub creator offers secure storage options for your payroll data. Look for software that encrypts sensitive information to protect against data breaches.

Cost: Consider the pricing structure of the paystub creator. Many offer affordable subscription plans, but you should choose one that fits within your budget and provides the features you need.

Conclusion

The shift from paper-based payroll systems to using a paystub creator represents a significant improvement in how businesses handle payroll. By switching to a digital solution, businesses can save time, reduce errors, improve compliance, and create professional-looking pay stubs that employees will appreciate.

In the fast-evolving world of business, embracing digital tools like a free paystub creator is not just an option; it’s the future of payroll management.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?