Introduction to Ripple XRP

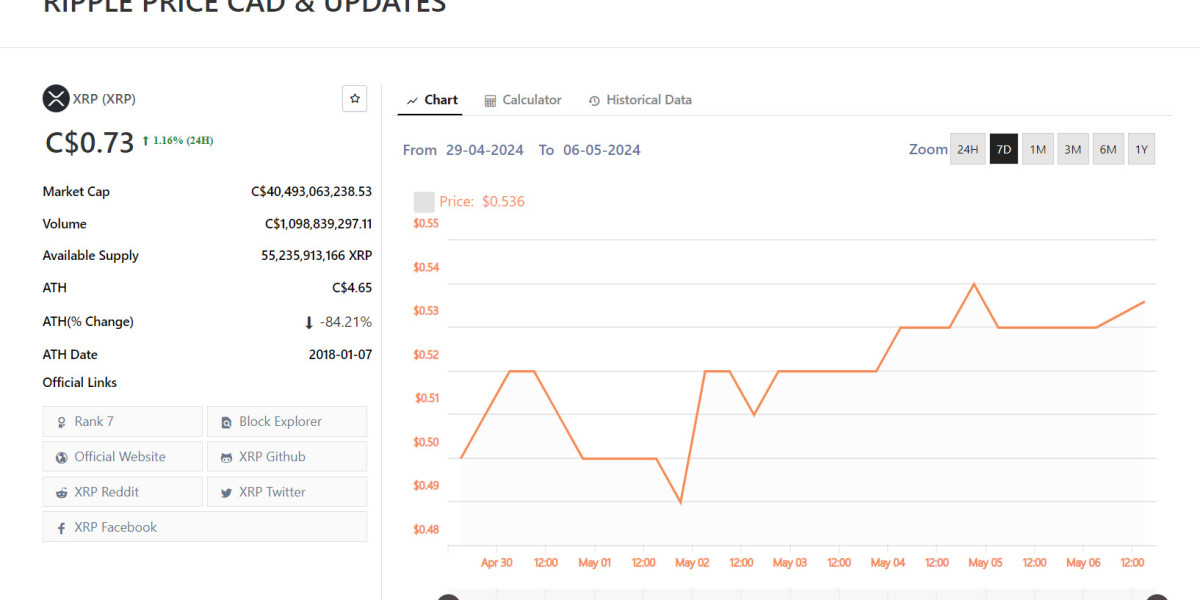

Ripple is a blockchain-based payment network and protocol that practices the XRP Ledger blockchain and XRP. Its native currency is known as XRP, which is used to facilitate low-cost cross-border transactions and offers liquidity for financial institutions. Nowadays, XRP’s price in CAD is around $0.60. Visit Maple Investments for more updates on XRP’s prices in Canadian Dollars.

Background of the creation and development

Ripple’s concept was initiated in 2011 by Ryan Fugger. Jed McCaleb and Chris Larsen co-founded Ripple Labs and initially contributed to developing this idea. The XRP Ledger was launched in 2012. This Ledger was a decentralized platform, which introduced XRP as its native cryptocurrency. Its initial focus was on creating a scalable and fast digital payment system for global transactions. Ripple launched RippleNet in 2015, a network for institutional providers. Key products like xCurrent, xRapid, and xVia were introduced and they gained traction among financial institutions and banks worldwide.

Moreover, Ripple continued to expand its global market network and enhance payment solutions. Ripple faced regularity scrutiny with a significant lawsuit from the U.S. Securities and Exchange Commission in 2020. Adding on, its technology continued to improve the XRP Ledger. Despite legal challenges, Ripple upholds and raises its ecosystem focusing on partnership and innovation.

Technology and Architecture of Ripple XRP

Ripple practices a unique consensus mechanism known as the Ripple Protocol Consensus Algorithm. After every few seconds, the network nodes decide which transactions to process by reaching a consensus. This is done through a procedure of electives where nodes suggest sets of transactions. This mechanism repeatedly improves these sets until they reach an agreement. This methodology safeguards energy-efficient and quick transaction validation.

The XRP Ledger is a decentralized blockchain technology at the back of Ripple. Although often related to the company Ripple Labs, XRP Ledger is an open-source product and is maintained by a worldwide developer community. The XRPL is a shared public ledger of all XRP transactions that have ever happened. It confirms the order and integrity of transactions without a central authority. This Ledger can process transactions within 3-5 seconds with minimal transaction fee.

Use cases and applications of Ripple XRP.

The primary use case of Ripple XRP is helping cross-border payments. Traditional ones can be costly and slow due to the involvement of intermediaries and fluctuating currency exchange rates. Whereas, XRP transactions settle in about 3-5 seconds. They are quicker than the traditional banking systems.

Ripple has shaped partnerships with several financial institutions and banks globally to streamline their payment procedures. Banks can use XRP as a linked currency to achieve liquidity more efficiently. They can hold XRP to ease instant transactions between different fiat currencies rather than holding various foreign currencies. Ripple’s on-demand liquidity service customs XRP delivers liquidity for cross-border transactions in real-time.

Ripple is discovering the potential of XRP in the rising field of decentralized finance. DeFi applications utilize XRP for borrowing and lending services. They allow users to earn interest on their XRP holding or borrow against them. Moving on, XRP can be traded on decentralized exchanges. These DEXs provide liquidity and allow users to trade XRP directly from their wallets without a centralized intermediary.

XRP can be combined into an online payment system and E-commerce platforms to provide a substitute payment method for customers. Online merchants can accept this Ledger as a payment method and deliver their customers with low-cost and fast options. XRP’s capability to ease cross-border payments can help merchants enlarge their reach to international customers without currency conversion.

Regulatory Environment of Ripple XRP

Ripple XRP operates in an evolving and complex regulatory landscape. Being a prominent cryptocurrency, it faces regulatory challenges and scrutiny from governments. One of its primary challenges is the classification of XRP. Unlike Ethereum and Bitcoin, XRP’s classification has been debated, mainly in the U.S. The core problem is whether this platform should be classified as a commodity or security. This classification influences how it is regulated and the legal duties of Ripple Labs and its holders.

Moving on, the U.S. SEC put forward a lawsuit against Ripple Labs in 2020. The SEC claimed that XRP is a security and Ripple’s sales of it were unregistered security aids. Ripple rejected these allegations and argued that XRP is a currency and not subject to SEC regulation. The consequence of this lawsuit has important implications for Ripple and the wider cryptocurrency market.

Ripple has taken steps to gain the necessary licenses and make sure of compliance to navigate the complex regulatory environment. It has obtained approvals and licenses from several regulatory bodies to operate its services. This platform also obeys anti-money laundering and know-your-customer regulations to prevent illegal activities. This submission is vital for maintaining partnerships with financial institutions and banks.

Just like in Canada, the regulatory environment for Ripple XRP is comparatively supportive yet cautious. Canada has formed a clear legal framework that treats cryptocurrencies depending on their uses and characteristics. The Canadian Securities Administrators and the Financial Transactions and Report Analysis Centre of Canada are the primary supervisory bodies overseeing cryptocurrency activities. Ripple and other crypto-related businesses must fulfill AML and KYC regulations to safeguard transparency and prevent illegal activities. Overall, their regulatory aims for financial stability in the cryptocurrency market.

Regulations have a profound impact on Ripple XRP which includes both positive and negative impacts.

Consistent and clear regulations can offer legal certainty and encourage adoption by investors and financial institutions. Regulatory obedience can grow trust and legitimacy and can attract more users to the Ripple network. On the other hand, regulatory challenges and lawsuits such as the SEC case can create a negative impact on XRP’s market adoption. Only limiting regulations could stifle innovations.

Future outlook

This Regulatory environment for Ripple XRP is predicted to keep on developing, with numerous key trends to watch.

The result of the SEC lawsuit will be a major factor in XRP’s regulatory status in the U.S. A promising outcome for Ripple could set an example for other cryptocurrencies. While a negative outcome could lead to a rise in regulatory scrutiny.

There is an increase in recognition of the essential for worldwide coordination in cryptocurrency regulation. Global organizations such as the Financial Action Task Force are working on strategies to ensure reliable approaches across authorities. As the cryptocurrency market evolves, regulators will keep updating and improving their frameworks.

Final words

lastly, Ripple XRP stands out as a revolutionary force in the world of DeFi. Despite facing notable regulatory challenges, Ripple’s strategic partnerships and technology continue to drive its influence and adoption. As this evolves globally, the future of Ripple XRP will depend on navigating such regulatory complexities.

So, if you’re interested in investing in Ripple XRP, Maple Investments is the leading choice.