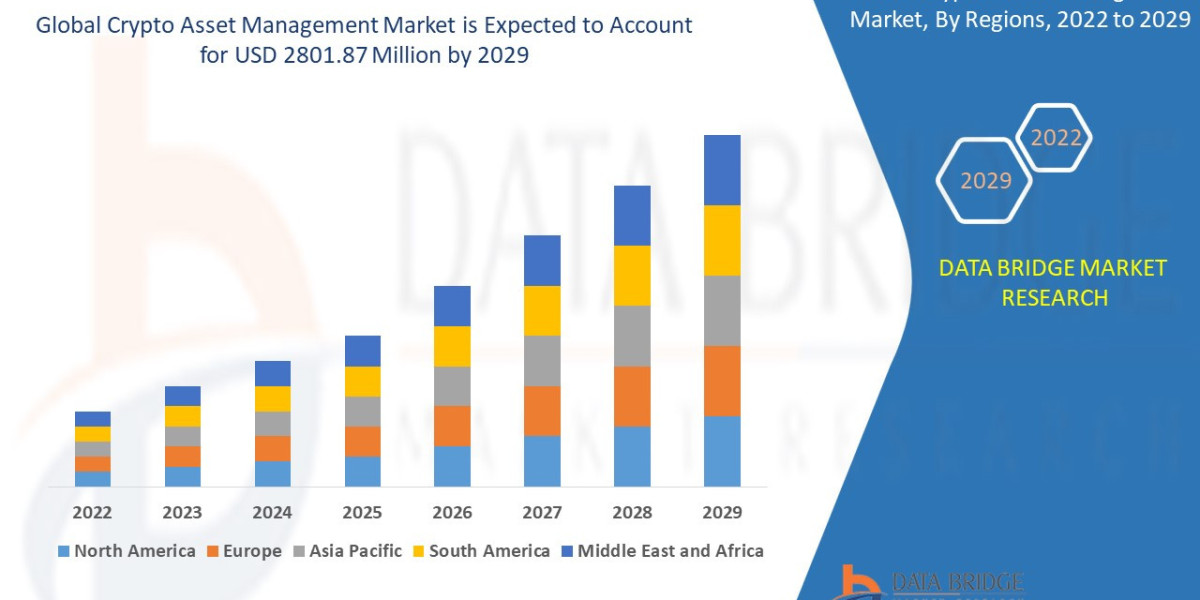

"Crypto Asset Management Market – Industry Trends and Forecast to 2029

Global Crypto Asset Management Market, By Solution (Custodian Solution, Wallet Management), Deployment (Cloud, On-Premises), Mobile Operating System (iOS, Android), Application (Web-Based, Mobile), End User (Individual, Enterprise), Enterprise Vertical (Institutions, Retail and E-Commerce, Healthcare, Travel and Hospitality, Others) – Industry Trends and Forecast to 2029.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-crypto-asset-management-market

The global crypto asset management market is witnessing significant growth attributed to the increasing adoption of digital currencies and blockchain technology. The market is driven by factors such as the need for secure storage solutions, rising demand for tokenization, and the growing popularity of decentralized finance (DeFi) applications. Additionally, the proliferation of cryptocurrency exchanges and trading platforms is fueling the demand for sophisticated asset management tools to navigate the complex crypto market landscape. Moreover, regulatory developments and institutional interest in cryptocurrencies are further driving the growth of the market.

**Segments**

- **By Deployment Type:** On-Premises, Cloud

- **By Application:** Portfolio Management, Custodian Solutions, Tokenization Platforms, Others

- **By End-User:** Institutional Investors, Retail Investors

The crypto asset management market is segmented based on deployment type, application, and end-user. In terms of deployment type, both on-premises and cloud-based solutions are available to cater to the diverse needs of businesses. The applications of crypto asset management include portfolio management, custodian solutions, tokenization platforms, and others, offering a range of services tailored to different requirements. Furthermore, the market serves various end-users, including institutional investors and retail investors, each with unique demands and preferences for managing their digital assets effectively.

**Market Players**

- Coinbase

- BitGo

- Ledger

- Gemini

- Bakkt

- Genesis Global Trading

- Grayscale Investments

- CoinTracker

- Crypto Finance AG

- Binance

A competitive landscape analysis reveals key market players in the crypto asset management sector. Companies such as Coinbase, BitGo, Ledger, Gemini, Bakkt, and others offer a wide range of solutions for secure storage, trading, and management of digital assets. Additionally, firms like Grayscale Investments, CoinTracker, and Crypto Finance AG provide specialized services to cater to the needs of institutional and individual investors in the cryptocurrency space. With the market witnessing rapid innovation and evolving regulatory landscape, these players are at the forefront of driving advancementsThe global crypto asset management market is experiencing robust growth due to a combination of factors contributing to its expansion. One of the primary drivers of this growth is the increasing adoption of digital currencies and blockchain technology across various industries. The versatility and efficiency offered by cryptocurrencies have attracted both institutional and retail investors to diversify their portfolios with digital assets. As traditional financial institutions and payment platforms integrate blockchain technology into their operations, the demand for crypto asset management solutions continues to surge.

The need for secure storage solutions is paramount in the crypto asset management market, given the highly volatile and decentralized nature of cryptocurrencies. Institutional investors, in particular, prioritize security measures to safeguard their substantial investments in digital assets. Companies providing custodian solutions play a vital role in offering secure storage and risk management services to mitigate potential threats such as hacking and fraud. This aspect of crypto asset management is crucial in building trust and confidence among investors, leading to increased market participation and capital inflows.

The rising demand for tokenization is another significant driver fueling the growth of the crypto asset management market. Tokenization platforms enable the digitization of real-world assets such as real estate, art, and commodities, allowing for fractional ownership and enhanced liquidity. This innovative approach to asset management appeals to a broad spectrum of investors seeking alternative investment opportunities in a rapidly evolving digital economy. By facilitating the tokenization of assets, crypto asset management firms contribute to the democratization of finance and the creation of new investment avenues accessible to a global audience.

Decentralized finance (DeFi) applications have emerged as a disruptive force in the crypto asset management landscape, providing decentralized alternatives to traditional financial services. DeFi platforms offer decentralized lending, borrowing, and trading services, eliminating the need for intermediaries and enabling peer-to-peer transactions. The growing popularity of DeFi among crypto enthusiasts and investors has spurred the development of sophisticated asset management tools tailored to navigate the diverse DeFi ecosystem. As DeFi continues to gain traction in the financial industry, crypto asset management firms are adapting their offerings to cater**Global Crypto Asset Management Market, By Solution (Custodian Solution, Wallet Management), Deployment (Cloud, On-Premises), Mobile Operating System (iOS, Android), Application (Web-Based, Mobile), End User (Individual, Enterprise), Enterprise Vertical (Institutions, Retail and E-Commerce, Healthcare, Travel and Hospitality, Others) – Industry Trends and Forecast to 2029.**

The global crypto asset management market is poised for significant growth as the adoption of digital currencies and blockchain technology continues to rise. In terms of solutions, the market offers a range of services such as custodian solutions and wallet management to cater to the diverse needs of businesses and investors. Deployment options including cloud-based and on-premises solutions provide flexibility and scalability for managing digital assets effectively. With the increasing use of mobile devices, compatibility with different mobile operating systems such as iOS and Android is essential for seamless access to crypto asset management tools. The market also caters to different end-users, including individual investors and enterprises, each with unique requirements for managing their digital assets. Across various enterprise verticals such as institutions, retail and e-commerce, healthcare, travel and hospitality, and others, the demand for crypto asset management solutions is on the rise.

The growth of the crypto asset management market is fueled by several key factors. The need for secure storage solutions remains a primary driver, with investors prioritizing security measures to protect their digital assets from potential risks. Custodian solutions play a crucial role in offering secure storage and

The Crypto Asset Management market research report displays a comprehensive study on production capacity, consumption, import and export for all the major regions across the globe. The target audience considered for this market study mainly consists of Key consulting companies & advisors, Large, medium, and small-sized enterprises, Venture capitalists, Value-added resellers (VARs), Third-party knowledge providers, Investment bankers, and Investors. This global market analysis report is the believable source for gaining the market research that will exponentially accelerate the business growth. The top notch Crypto Asset Management market report is the best option to acquire a professional in-depth study on the current state for the market.

Table of Contents: Crypto Asset Management Market

1 Introduction

2 Global Crypto Asset Management Market Segmentation

3 Executive Summary

4 Premium Insight

5 Market Overview

6 Crypto Asset Management Market, by Product Type

7 Crypto Asset Management Market, by Modality

8 Crypto Asset Management Market, by Type

9 Crypto Asset Management Market, by Mode

10 Crypto Asset Management Market, by End User

12 Crypto Asset Management Market, by Geography

12 Crypto Asset Management Market, Company Landscape

13 Swot Analysis

14 Company Profiles

Countries Studied:

- North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

- Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

- Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

- Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Browse Trending Reports:

Streptococcus Infection Market

Renal Panel Testing Market

Form Fill Seal Ffs Films Market

Grant Management Software Market

Omega 8 Pufa Market

Specialty Nitrile Butadiene Rubber Market

Protein In Infant Formula Market

Electric Orthopedic Screwdriver Market

Sodium Benzoate Market

Aloe Vera Juice Market

Digital Photo Frames Market

Cosmetic Bottle Market

Silage Inoculants And Enzymes Market

Multihead Weighers Market

Food Additives Market

Amino Acids Based Biostimulants Market

Outdoor Living Products Market

Diagnostic Reagents Market

Grain Protectants Market

Multiplex Testing Market

Vehicle Tracking System Market

Hematopoietic Agents Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975