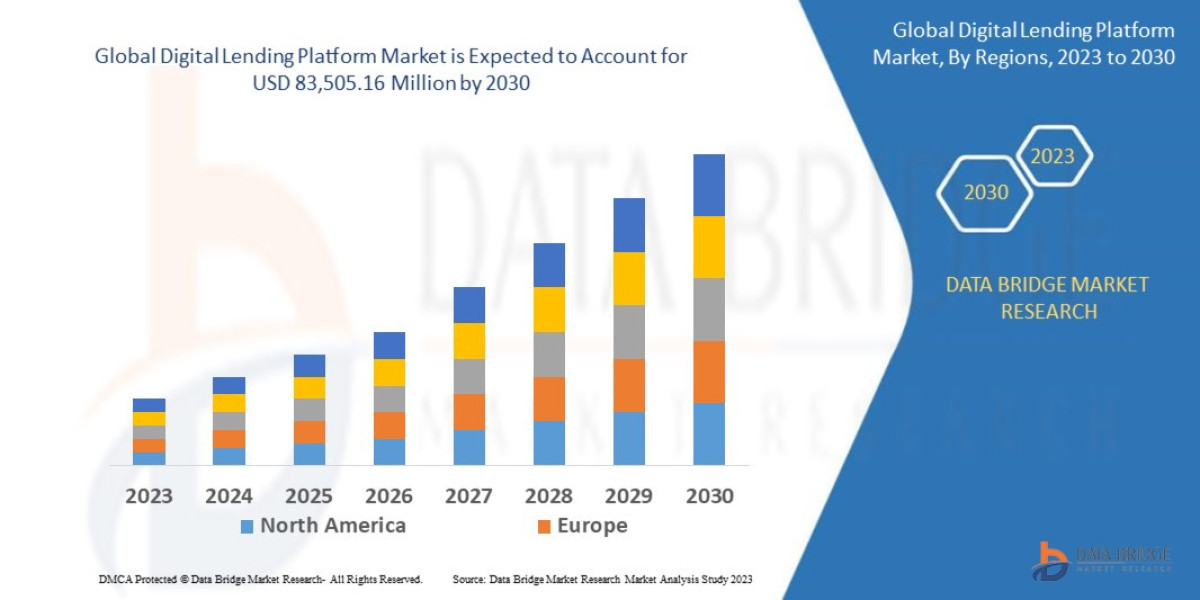

"Global Digital Lending Platform Market – Industry Trends and Forecast to 2030

Global Digital Lending Platform Market, By Component (Solutions, Services), Deployment Model (On Premises, Cloud), Loan Amount Size (Less than US$ 7,000, US$ 7,001 to US$ 20,000, More than US$ 20,001), Subscription Type (Free, Paid), Loan Type (Automotive Loan, SME Finance Loan, Personal Loan, Home Loan, Consumer Durable, Others), Vertical (Banking, Financial Services, Insurance Companies, P2P (Peer-to-Peer) Lenders, Credit Unions, Saving and Loan Associations) – Industry Trends and Forecast to 2030.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-digital-lending-platform-market

**Segments**

- **Type:** The digital lending platform market can be segmented based on type into:

- Loan origination

- Decision automation

- Loan management

- Risk and compliance management

- Others

- **Deployment:** This market can also be categorized by deployment mode:

- On-premises

- Cloud-based

- **End-User:** The end-user segmentation of the digital lending platform market includes:

- Banks

- Credit unions

- FinTech companies

- Others

**Market Players**

- **Ellie Mae Inc.**

- **Fiserv, Inc.**

- **FIS**

- **Newgen Software**

- **CU Direct Corporation**

- **Sigma Infosolutions**

- **Pegasystems Inc.**

- **Temenos Headquarters SA**

- **Q2 Software, Inc.**

- **P2P lending Ltd.**

The global digital lending platform market is witnessing significant growth due to the increasing adoption of digitalization in the lending process. The market segmentation based on type includes loan origination, decision automation, loan management, risk and compliance management, among others. Loan origination solutions are crucial for digital lending platforms as they help in automating the entire loan application process, reducing manual effort, and enhancing operational efficiency. Decision automation tools enable quick and accurate credit assessments, resulting in faster loan approvals. Loan management solutions are essential for managing loan portfolios efficiently and ensuring timely repayments from borrowers. Risk and compliance management tools play a vital role in maintaining regulatory compliance and managing credit risks effectively.

Regarding deployment modes, the digital lending platform market offers options such as on-premises and cloud-based solutions. On-premises deployment provides greater control over data and systems for organizations that prioritize security and compliance. Cloud-based deployment, on the other hand, offers scalability, flexibility, and cost-effectiveness, making it a preferred choice for many financial institutions and FinTech companies.

In terms ofThe global digital lending platform market is experiencing a rapid transformation driven by the escalating demand for technology-driven solutions within the lending sector. One of the key factors influencing market growth is the shift towards a more streamlined and digitized lending process to enhance operational efficiency and improve customer experience. As the market continues to evolve, key players are focusing on developing advanced solutions that cater to the diverse needs of financial institutions, FinTech companies, and other end-users in the lending ecosystem.

The competitive landscape of the digital lending platform market is characterized by the presence of established players such as Ellie Mae Inc., Fiserv, Inc., and FIS, along with emerging players like Sigma Infosolutions and P2P lending Ltd. These companies are continuously innovating and expanding their product portfolios to stay ahead in the market. For instance, Ellie Mae Inc. offers comprehensive loan origination solutions, while Fiserv, Inc. specializes in decision automation tools that enable faster credit assessments. Newgen Software is known for its robust loan management solutions, whereas CU Direct Corporation focuses on risk and compliance management.

The market players are also leveraging strategic partnerships and collaborations to enhance their market presence and reach a broader customer base. For example, partnerships between technology providers and financial institutions are driving the adoption of digital lending platforms, leading to increased market penetration and revenue growth. Additionally, advancements in technologies such as artificial intelligence, machine learning, and blockchain are reshaping the digital lending landscape, enabling more personalized lending experiences and improved risk management capabilities.

The end-users of digital lending platforms, including banks, credit unions, and FinTech companies, are increasingly recognizing the benefits of adopting digital solutions to streamline their lending operations, reduce operational costs, and mitigate risks. Banks, in particular, are investing in digital lending platforms to offer seamless and efficient loan services to their customers, thereby improving customer satisfaction and retention. Credit unions are also embracing digitalization to enhance member engagement and drive competitive differentiation in the market.

As the digital lending platform market continues to evolve, regulatory compliance and**Segments**

- **Global Digital Lending Platform Market, By Component (Solutions, Services), Deployment Model (On Premises, Cloud), Loan Amount Size (Less than US$ 7,000, US$ 7,001 to US$ 20,000, More than US$ 20,001), Subscription Type (Free, Paid), Loan Type (Automotive Loan, SME Finance Loan, Personal Loan, Home Loan, Consumer Durable, Others), Vertical (Banking, Financial Services, Insurance Companies, P2P (Peer-to-Peer) Lenders, Credit Unions, Saving and Loan Associations) – Industry Trends and Forecast to 2030.

The digital lending platform market is experiencing robust growth globally, driven by the increasing adoption of digital solutions in the lending sector. The market segmentation based on components includes solutions and services, catering to the diverse needs of financial institutions, FinTech companies, and other end-users. Solutions such as loan origination, decision automation, loan management, and risk and compliance management play a crucial role in streamlining the lending process and enhancing efficiency. Services offered in the market encompass implementation, consulting, and support services, ensuring smooth integration and operation of digital lending platforms.

Deployment models, such as on-premises and cloud-based solutions, offer organizations flexibility and scalability in choosing the right infrastructure for their lending operations. On-premises deployment provides greater control and customization options for businesses that prioritize data security and compliance. In contrast,

Key points covered in the report: -

- The pivotal aspect considered in the global Digital Lending Platform Market report consists of the major competitors functioning in the global market.

- The report includes profiles of companies with prominent positions in the global market.

- The sales, corporate strategies and technical capabilities of key manufacturers are also mentioned in the report.

- The driving factors for the growth of the global Digital Lending Platform Market are thoroughly explained along with in-depth descriptions of the industry end users.

- The report also elucidates important application segments of the global market to readers/users.

- This report performs a SWOT analysis of the market. In the final section, the report recalls the sentiments and perspectives of industry-prepared and trained experts.

- The experts also evaluate the export/import policies that might propel the growth of the Global Digital Lending Platform Market.

- The Global Digital Lending Platform Market report provides valuable information for policymakers, investors, stakeholders, service providers, producers, suppliers, and organizations operating in the industry and looking to purchase this research document.

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Digital Lending Platform Market Landscape

Part 04: Global Digital Lending Platform Market Sizing

Part 05: Global Digital Lending Platform Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Reasons to Buy:

- Review the scope of the Digital Lending Platform Market with recent trends and SWOT analysis.

- Outline of market dynamics coupled with market growth effects in coming years.

- Digital Lending Platform Market segmentation analysis includes qualitative and quantitative research, including the impact of economic and non-economic aspects.

- Regional and country level analysis combining Digital Lending Platform Market and supply forces that are affecting the growth of the market.

- Market value data (millions of US dollars) and volume (millions of units) for each segment and sub-segment.

- and strategies adopted by the players in the last five years.

Browse Trending Reports:

Lab Supplies Market

Autonomous Agents Market

System In Package Sip Technology Market

Gas Equipment Market

Endocarditis Drug Market

Luxury Folding Carton Market

Womens Health Market

Visual Effects Market

Converting Paper Market

Photophobia Drug Market

Food Allergens And Intolerance Testing Market

Kombucha Market

Fishmeal Fish Oil Market

Anti Uav Defence System Market

Automotive Battery Thermal Management System Market

Cardiac Resynchronization Therapy Market

Circulating Tumor Cells Ctc Market

Epilepsy Market

Medical Writing Market

Virtual Machine Software Market

Pallet Displays Market

Hospital Treated Gram Negative Infections Market

Mattress Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975