The steel industry stands as a cornerstone of the global economy, integral to infrastructure, automotive, construction, and numerous other sectors. Understanding steel price trend is crucial for businesses, investors, and policymakers alike. This article explores the factors influencing steel prices, current market trends, and the outlook for the future.

Global Steel Production and Consumption Patterns

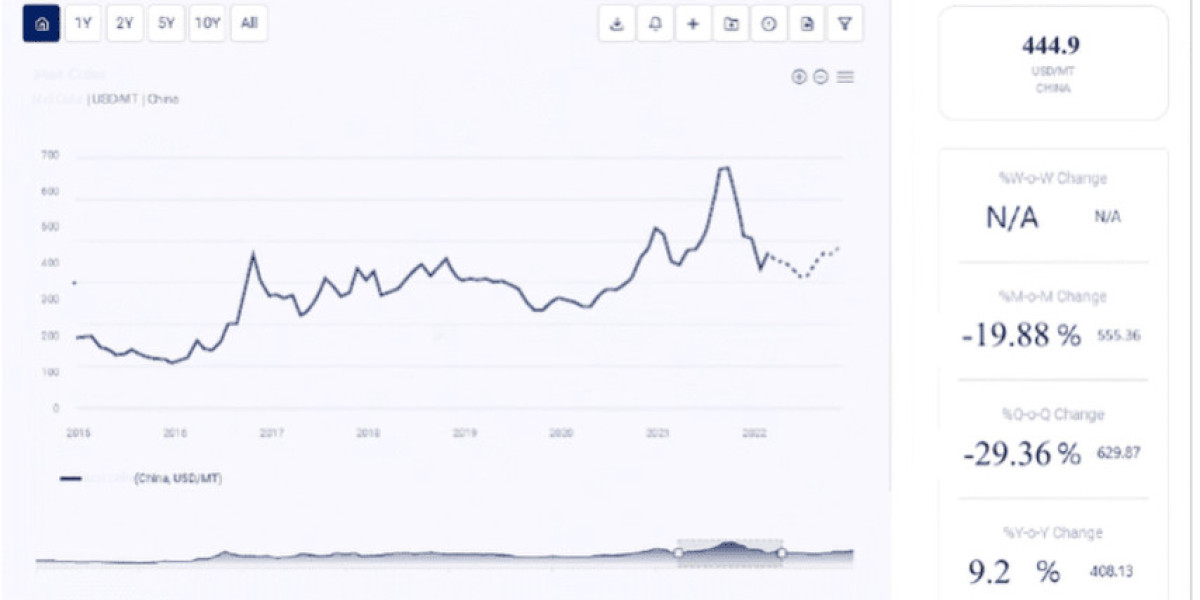

Global steel production and consumption trends are primary determinants of steel prices. According to the World Steel Association, production levels have fluctuated in recent years due to economic cycles, geopolitical events, and technological advancements.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/steel-price-trends/pricerequest

- Production Trends:

- China: As the leading steel producer globally, China’s production levels significantly impact global prices. Efforts to reduce carbon emissions have led to output fluctuations, affecting the global supply chain.

- India: India’s steel production has been increasing, driven by domestic demand and governmental initiatives aimed at boosting infrastructure.

- Europe and North America: These regions have faced production challenges due to high energy costs and stringent regulations.

- Consumption Patterns:

- Construction Sector: Being the largest consumer of steel, the construction industry’s demand is driven by economic growth, urbanization, and infrastructure development.

- Automotive Industry: Steel is essential in vehicle manufacturing, and trends in automotive sales and production significantly influence steel consumption.

- Manufacturing: Various manufacturing industries, including machinery and appliances, rely heavily on steel, and their economic health impacts steel demand.

Key Drivers of Steel Prices

Several factors influence steel prices, including supply-demand dynamics, raw material costs, energy prices, and geopolitical events.

- Supply and Demand:

- Overcapacity: Overproduction can lead to a surplus, driving prices down, while supply constraints can push prices up.

- Demand Shocks: Economic downturns or booms can cause sudden demand changes, impacting prices.

- Raw Material Costs:

- Iron Ore and Coal: Steel production requires substantial amounts of iron ore and coking coal, and their prices directly affect steel costs.

- Recycling: The availability and cost of scrap metal for recycling also play a role in steel pricing.

- Energy Prices:

- Electricity and Gas: Energy-intensive steel production processes make energy prices a critical cost factor.

- Renewable Energy Transition: The shift towards renewable energy sources can impact production costs and prices.

- Geopolitical Events:

- Trade Policies: Tariffs, trade agreements, and sanctions can alter the competitive landscape and affect steel prices.

- Conflicts and Instability: Political instability in major steel-producing or consuming regions can disrupt supply chains and impact prices.

Current Trends in the Steel Market

The steel market is influenced by several current trends, including technological advancements, environmental regulations, and shifts in global trade dynamics.

- Technological Advancements:

- Automation and AI: Integrating automation and artificial intelligence in steel production enhances efficiency and reduces costs.

- Innovative Products: Developing high-strength, lightweight steel and other innovative products caters to evolving market needs.

- Environmental Regulations:

- Carbon Emission Reduction: Governments and organizations are increasingly focused on reducing carbon emissions in steel production, driving investments in cleaner technologies and altering production costs.

- Circular Economy: Emphasis on recycling and sustainable practices is reshaping the steel industry.

- Global Trade Dynamics:

- US-China Trade Relations: Trade tensions between major economies can affect global steel trade flows and prices.

- Regional Trade Agreements: New trade agreements or changes to existing ones impact market access and competitive dynamics.

Future Outlook for Steel Prices

Predicting future steel prices involves analyzing various economic indicators, market trends, and potential disruptions. Experts provide differing views based on these factors:

- Economic Growth Projections:

- Global GDP: The health of the global economy, as reflected in GDP growth rates, influences steel demand and prices.

- Sector-Specific Growth: Projections for growth in construction, automotive, and manufacturing sectors provide insights into future steel demand.

- Technological and Environmental Factors:

- Green Steel Production: Advances in green steel technologies and increased regulatory pressures for sustainable production may impact future prices.

- Energy Transition: The shift towards renewable energy sources and its effect on production costs will be a key factor in determining future prices.

- Geopolitical Stability:

- Policy Changes: Changes in trade policies, tariffs, and international relations will continue to influence steel prices.

- Conflict and Stability: Political stability in major steel-producing regions will affect supply chains and market dynamics.

Strategic Considerations for Businesses and Investors

Businesses and investors need to adopt strategic approaches to navigate the complexities of the steel market. Here are some key considerations:

- Supply Chain Management:

- Diversification: Diversifying supply sources can mitigate risks associated with supply chain disruptions.

- Long-Term Contracts: Entering into long-term contracts with suppliers can provide price stability and reduce exposure to market volatility.

- Investment in Technology:

- Efficiency Improvements: Investing in advanced technologies can enhance production efficiency and reduce costs.

- Sustainable Practices: Adopting sustainable practices and technologies can align with regulatory trends and consumer preferences.

- Market Analysis and Forecasting:

- Data-Driven Insights: Utilizing data analytics and market intelligence can provide valuable insights for strategic decision-making.

- Scenario Planning: Preparing for different market scenarios can help businesses and investors stay resilient amid uncertainties.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA